SIP In Mutual Funds

Systematic Investment Plans (SIPs) in mutual funds are a disciplined way of creating wealth over the long-term. Invest small amount of money at fixed intervals to create a substantial corpus over long periods of time.

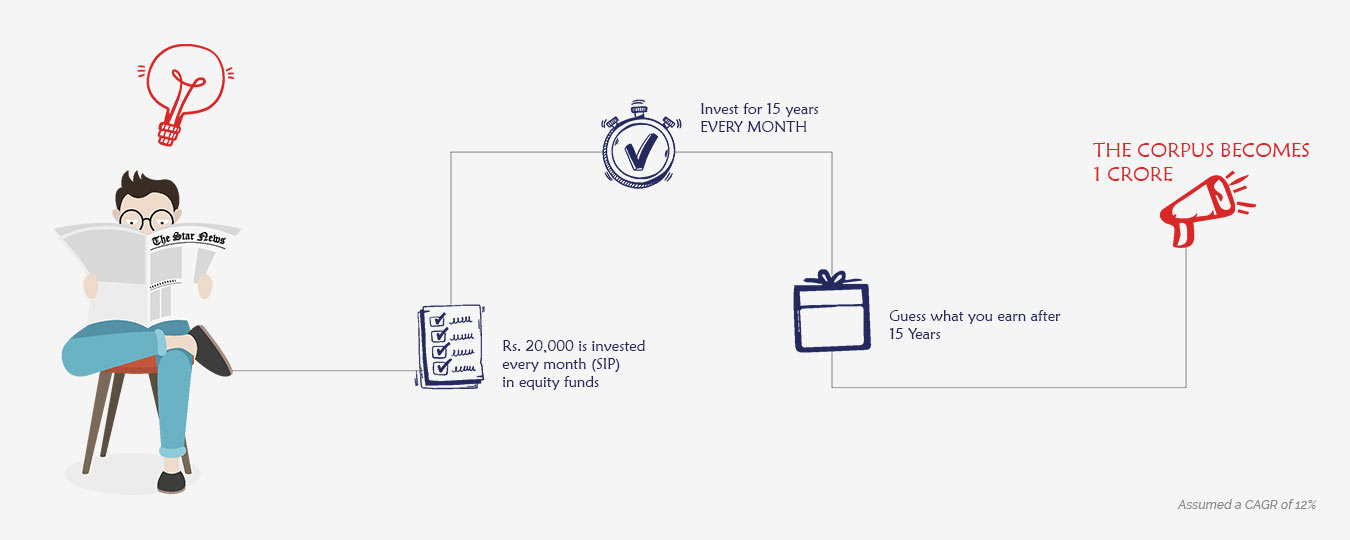

A monthly installment of INR 20,000 in a portfolio of mutual funds can make you a Crorepati in just about 15 years! Invest in SIP online to take advantage of the magic of compounding!

A monthly installment of INR 20,000 in a portfolio of mutual funds can make you a Crorepati in just about 15 years! Invest in SIP online to take advantage of the magic of compounding!