CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 5-May-23 | 28-Apr-23 | Change |

| Nifty 50 | 18,067 | 18,065 | 0.01% |

| Nifty 500 | 15,277 | 15,219 | 0.38% |

| Nifty Midcap 50 | 9,035 | 8,962 | 0.81% |

| Nifty Smallcap 100 | 9,733 | 9,672 | 0.63% |

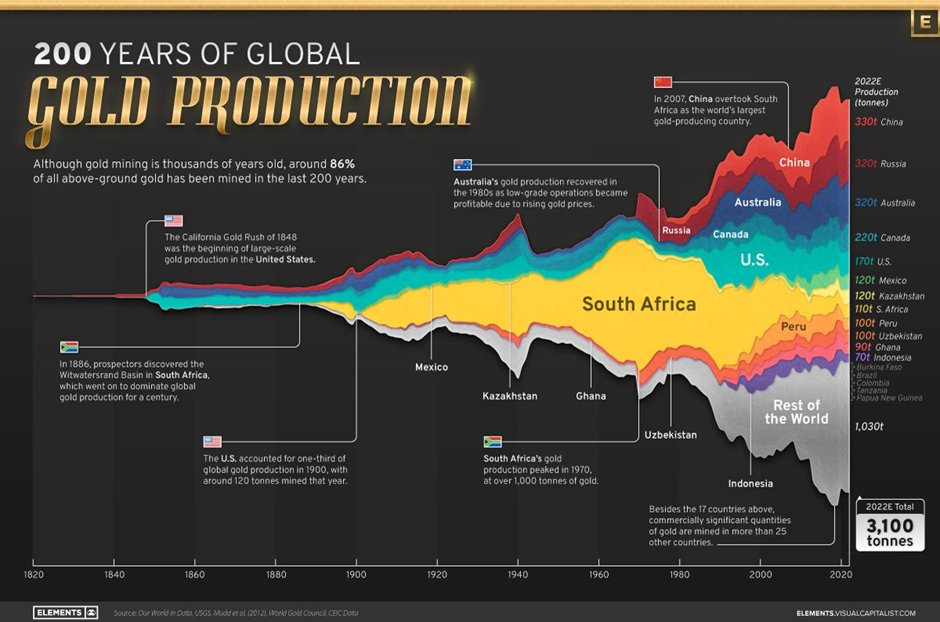

Chart Ki Baat

Gyaan Ki Baat.

Diversification is a risk management strategy that involves holding your money across an array of different investments to reduce your risk exposure.

Investing the majority of your corpus in the same industry or asset class increases portfolio risk. Diversification doesn’t just mean holding a bunch of different stocks, it works best when positions in your portfolio are uncorrelated meaning that their correlation coefficient is close to zero. All this means that the stock prices need to move at least somewhat independently of one another.

Such diversification can be achieved by allocation of funds across asset classes and within classes, and also geographically by investing in both domestic and foreign markets. This way, even if a particular industry or sector underperforms, it has a controlled or limited effect on your portfolio. Whereas other investments with positive performance will likely offset these negative returns.

Here’s the list of curated readings for you this week:

Personal Finance

- EPFO extends deadline to apply for higher pension till June 26 – Retirement fund body EPFO on Tuesday extended the deadline to apply for higher pension till June 26. Read here.

- Who will bear the extra cost of Higher pensions by EPFO? – It has been decided to draw a 1.16 percent additional contribution from within the overall 12 percent of the contribution of the employers into the provident fundRead here.

- Shruti shares her experience of a visit to the LIC office in Chembur, Mumbai. Two things happened when I went there. Read the 2 part series here.

- The tragedy called SEBI’s RIA regulations- RIAs are concerned that their communication with existing clients might be hit because of the new regulation on advertisements. Apart from this, industry sources tell CNBC-TV18 that Sebi is also planning on formulating a centralised investment account for RIAs to collect money from investors. Read here.

- 3 chart updates on the Markets – Sharp rally in Indian markets in April, as FIIs make a comeback. Read here.

- How to analyze Steel Industry? – Valuepickr Forum – Presentation covering commodities/steel cycle decision-making aspect. Read here

- India’s High Corporate Tax Rate is Holding Back Corporate Capex – Not only does India’s high corporate tax disincentivize capex (as explained by steel case study outlined above), but it also puts India at a competitive disadvantage to China. Read here

- Will forcing PSUs to pay dividends make them more valuable? – Stocks that have “Gujarat” in their name are hugely up the next day (April 26). Simply because oh, some news has come, and it sounds good.. Read here

- How Interest Rates & Inflation Impact Stock Market Valuations – This trend makes sense intuitively. The higher the inflation rate, the lower the valuation averages. The relationship between interest rates and valuations is not quite as clearcut. Read here

Economy

- Fed raises rates, opens door to pause in tightening cycle – The Federal Reserve moved its management of the post-pandemic economic recovery into a new phase on Wednesday with what may be the last in a historic series of interest rate hikes and heightened attention to credit and other economic risks. Read here

- India state govt’s FY24 borrowings seen lower due to off-balance sheet debt – sources– Lower market borrowing by state governments was one factor that helped keep federal government bond yields in check in 2022-2023.Read more here.

- JPM buys First Republic bank – The US banking behemoth said in a statement it will take $173 billion of loans and about $30 billion of securities of First Republic Bank including $92 billion of deposits. However, it will not assume the bank’s corporate debt or preferred stock.Read here

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.