CAGR Insights is a weekly newsletter full of insights from around the world of the web.

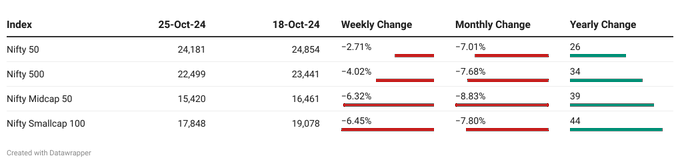

Chart Ki Baat

Gyaan Ki Baat

The Power of “Tax-Loss Harvesting” for Reducing Tax Liabilities

Tax-loss harvesting is a strategy that involves selling investments at a loss to offset capital gains taxes on other profitable investments. This approach can be especially useful when you’re looking to reduce your tax bill at the end of the financial year. You can balance out your gains and minimize taxable income by realizing losses in underperforming assets. It’s important to repurchase similar assets after a waiting period to avoid “wash-sale” rules, but this strategy can significantly improve your overall tax efficiency, making it a powerful tool for savvy investors.

Personal Finance

- NRIs can use UPI for fee-free transactions with people in India: The NPCI has extended UPI access to NRIs holding NRE/NRO accounts. NRIs can now make fee-free UPI transactions using international mobile numbers through apps like PhonePe, iMobile, and BHIM. The service is available in several countries and has a daily transaction limit of ₹1 lakh. Read here

- RBI makes six amendments to know-your-customer (KYC) rules: The Reserve Bank of India (RBI) has announced amendments to the Master Directions on Know Your Customer (KYC) on November 6, 2024, and the amended provisions in the Master Direction shall come into force with immediate effect. Read here

- Nearly 3 in 4 Posts on Social Media With Financial Advice Are ‘Misleading,’ According to a New Report: Nearly three-quarters of financial advice on social media is misleading, a new report reveals. Don’t let bad advice ruin your financial future. Protect yourself by verifying information from reliable sources. Read here

Investing

- Federal Reserve cuts interest rates by a quarter point: The U.S. Federal Reserve cut its interest rate by 0.25% to a 4.5%-4.75% range, focusing on balanced economic risks. Chair Powell emphasized that monetary policy remains restrictive to maintain employment and inflation goals despite positive economic data. Read here

- A Framework For The Cyclical Industries: Cyclical industries offer unique investment opportunities. By understanding the underlying factors driving these cycles, investors can identify undervalued companies poised for future growth. Read here

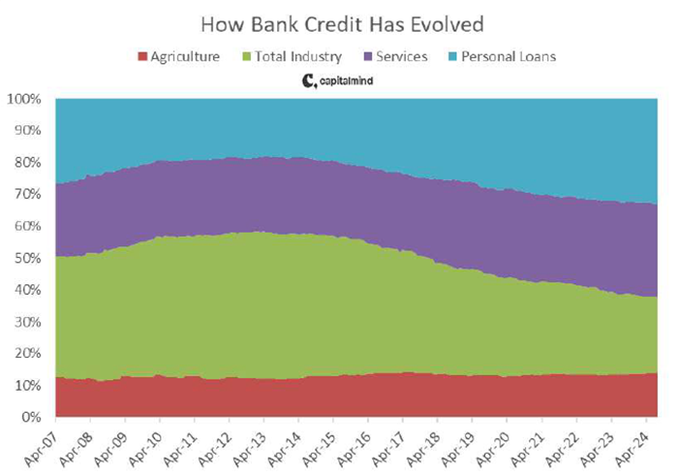

- RBI ‘watchful’ of unsecured loan flows into stock market says Shaktikanta Das: RBI Governor Shaktikanta Das cautioned banks to monitor unsecured loans potentially entering the stock market, citing anecdotal evidence but no concrete data. RBI has increased regulatory scrutiny, setting lending caps, though systemic risk remains low for now. Read here

- Sebi Allows MFs to Invest in Foreign Funds with Indian Assets: SEBI has allowed Indian mutual funds to invest in overseas mutual funds or unit trusts with up to 25% exposure to Indian securities. The move aims to ease investments, enhance transparency, and prevent conflicts of interest, effective immediately. Read here

Economy & Sectors

- Quick Commerce – Can it revolutionize the retail industry? Quick commerce is the future of retail. Imagine your groceries arriving in minutes, not hours. Companies like Zepto, Blinkit, and Instamart are making this a reality, transforming the way we shop. Watch here

- India may seek a deal to blunt Trump’s tariff threat: The Trump presidency may offer India trade opportunities, particularly if it adapts to tariff hikes and negotiates concessions on key products. India’s strong export surplus with the US could face risks, but cooperation in areas like defense, services, and technology may grow. Read here

- Indian economy expected to follow its natural course of modest growth: India’s economic journey is filled with promise, driven by strong services exports and remittances. While challenges remain, including government spending and investment gaps, the country’s entrepreneurial spirit and steady growth offer a solid foundation for future prosperity. Read here

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.