Last month I met a friend who was visiting Delhi for a mid – month break. Molly (name changed) was into sales of carbonated drinks and work brought her to Delhi on a Friday. So she stayed back and decided to spend some time off with her cousins and friends.

We went to this cosy little Italian place in GK 1 and promised each other to pen down 5 stars on Zomato for the heavy doses of heavenly pasta that we had. We quibbled a little on who should pay the bill and then we dropped both our cards on to the bill tray. Swipe. Up went an eye brow and five fine lines cuddled up into a frown on her forehead. I knew what was wrong. It was 20th of the month and her bank balance was into a low 4-digit number. No, credit card was not her solution. She was just unable to save what she wanted to save every month. And as result, she had been deferring her much coveted Euro trip for over a year now. Because she never had enough surplus to fund her desires, sorry – foreign vacation desires.

Molly was a quintessential corporate working girl. She was realistically ambitious, driven to deliver more than expected, eager to learn and extremely proactive. However, with over 3 years of work experience now, she was still far from financial independence.

That evening I went back and thought – why a good part of our generation (Read: Millennials) is so professionally accomplished yet financially poor. At this age, our parents were probably running a family of five. And we struggle to scrape through a month. A lot of this has a very deep connection to our habits and behaviours. Let me list down what comes to my mind.

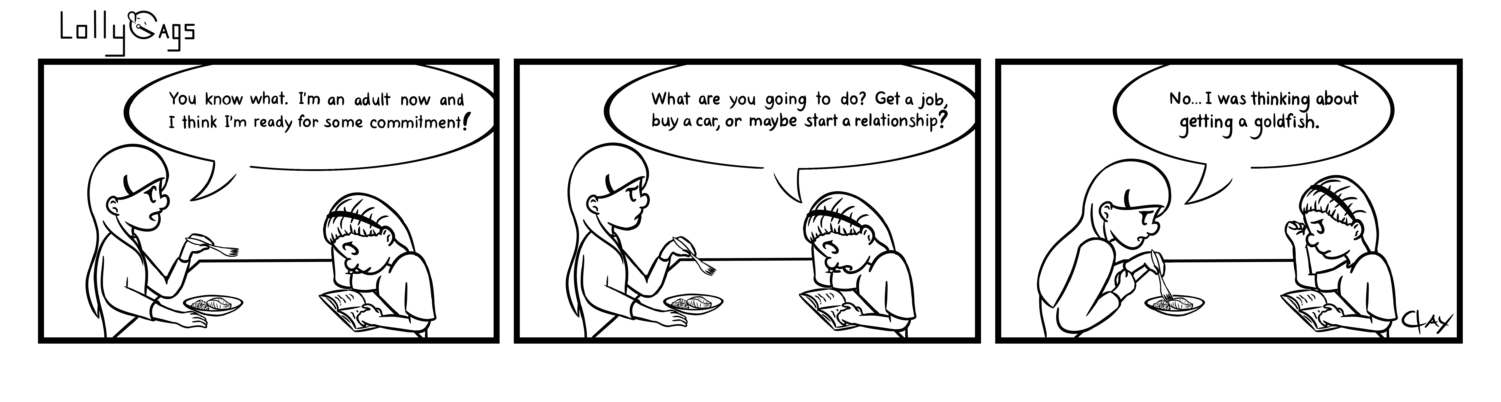

We don’t want to grow up

Credits: thevanguardusa.com

The spending priorities of our generation are extremely different from that of our parents. With the luxury to spend only on ourselves, we experience negligible levels of financial responsibility. And our inexperience at “adulting” reflects in how we manage our money.

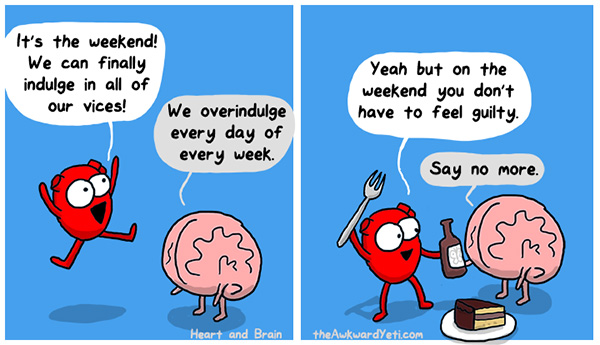

We fail to delay gratification

Credits: theawkwardyeti.com

Our generation is more here and now. We want quick replies to emails and hate to wait for the next sale in H&M. We also always want the latest in town. Since we don’t have much responsibilities (Refer the first point), we have this innate urge to gratify ourselves immediately. We believe in living now than living long. Even if that means possessing three credit cards.

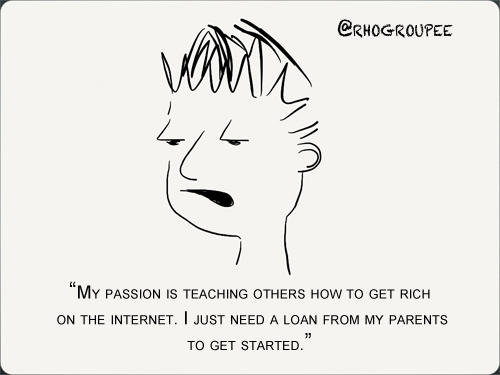

Likewise, we want to get rich quick

Everyone wants to double their money within a year. Everyone also wants to step out richer from a casino. Neither of this happens to everyone and every time. If we want to stay rich for a long period of time, we need to deploy our money carefully, rationally and patiently. There are no shortcuts to securing a good life for one’s own self.

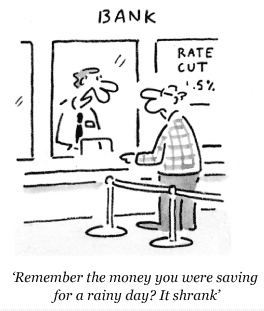

We misunderstand saving for our future

Credits: Matt from the Daily Telegraph

We get a misplaced sense of security when we put a certain amount of surplus in our banks. We also feel proud of ourselves since we took a stab at “Saving”. But sadly, the world has move past the era when savings were enough for livelihood. Our ever increasing standard of living coupled with rising costs is a double whammy. And savings can do nothing but give us a false sense of security and sufficiency. Investing is the new saving.

About the author:

Shruti is a financial planning enthusiast and spends substantial amount of her free time in helping out her friends and relatives sorting out their finances. Currently working with Mahindra & Mahindra, she is one of our esteemed guest writers. She is an MBA from MDI Gurgaon and a CFA (CFA Institute, USA).

About CAGRfunds:

We are a bunch of financial experts who help people manage and grow their wealth. We focus on making our clients financially independent by educating them and guiding them throughout their financial journey. If you think you need help with your money, reach out to us on +91 97693 56440.