CAGR Insights is a weekly newsletter full of insights from around the world of the web.

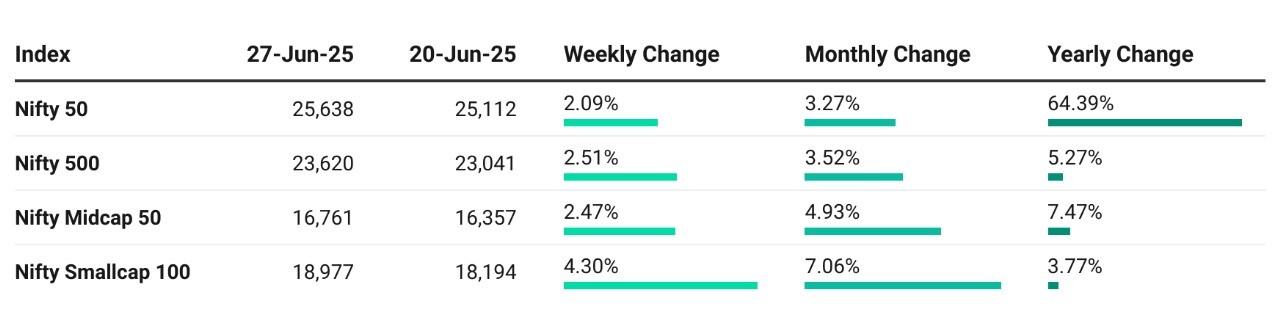

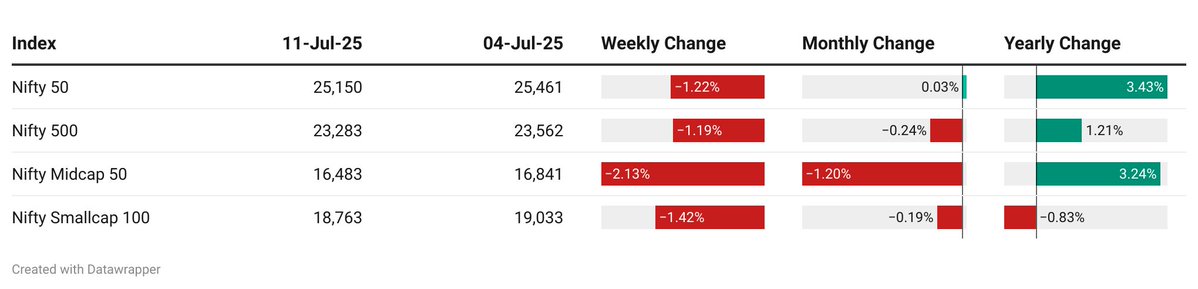

Chart Ki Baat

Gyaan Ki Baat

When Speed Becomes the Game

What happens when you pack your portfolio with the fastest-rising stocks?

In 2023, it meant celebration—momentum funds returned 42%, flexi-caps trailed at 29%. Momentum became the darling of the bull market. Portfolios soared. Investors cheered. And fund assets tripled in four years.

But trends, by nature, don’t last forever.

Fast forward to now: the same funds that topped charts are sitting at the bottom decile. One sharp correction, and the thrill turned into whiplash. Momentum didn’t just dip—it dove. Why? Because when sentiment breaks, momentum doesn’t stroll out. It bolts. No loyalists, no long-term believers—just silence and selling.

A quick look at the Nifty 200 Momentum 30 shows a beta of 1.20 and downside capture of 1.43. In simple terms: when the market falls, it falls harder.

So where does that leave investors?

Some are now looking at the 11% overlap between momentum and flexi-cap portfolios and seeing opportunity. Different stocks. Different cycles. A possible edge. Others are noticing how most flexi-cap funds held up better in the correction.

Momentum isn’t just a strategy—it’s a mood. One that rises fast but also tests your nerves when things turn. The game isn’t just about catching trends. It’s about knowing when you’re riding one—and when the trend is riding you.

Some are not discarding momentum—but domesticating it. Keeping it to 10–30% of the portfolio and pairing it with flexi-cap or multi-cap funds that can adapt.

Because sometimes, it’s not about choosing sides—it’s about building balance.

Personal Finance

- Will 77% Indian families retire poorer than they should? In 2023–24, household wealth in India surged by over 19 per cent. But here’s the catch: a big chunk of that growth didn’t come from saving more — it came from being invested in the right places. So, want to know where Indian households are saving their money, as per the latest RBI report? Read here

- EPF, NPS, PPF: How much should you invest in these schemes monthly to build a Rs 5 crore retirement corpus? Planning to build a Rs 5 crore retirement fund by age 60? Here’s a detailed comparison of EPF, NPS, and PPF to help you choose the best scheme in 2025. Learn about returns, tax benefits, risks, and expert-backed strategies. Read here

- Changed jobs recently? Here’s how to file ITR without any errors: Switching jobs mid-year can complicate tax filing, but with a little attention to detail, you can avoid common mistakes. As experts say, ‘A few extra steps today can save you headaches tomorrow. Read here

- How to Make More Without Working More: Making more without working more. It’s the holy grail of personal finance. But is it as difficult to achieve as it seems? Or are there actual ways to increase your earnings without needing to increase your effort? Read here

Investing

- Assumptions Can Be Costly in the Markets: Imagine you’re the Thanksgiving turkey—fed daily, life feels secure. But then, the unexpected happens. Like markets, the past doesn’t guarantee the future. Want to invest smarter? Build a rule-based system that ignores emotion and survives any market. Ready to rethink? Read here

- The performance of safe haven assets during geopolitical conflicts: Geopolitical conflicts have historically influenced financial markets, prompting investors to seek refuge in safe haven assets. But how do these assets perform when crises erupt, and which ones offer the most reliable protection?Read here

Economy & Sector

- India’s Export Boost for Economic Growth: To boost exports and become the world’s 3rd-largest economy, India must invest in its shipping sector, says Minister Shantanu Thakur. What’s key? Faster transport, AI-driven logistics, better connectivity, and adding more value to Indian products. Thoughts? Read here

- How India’s hospitality boom is reshaping talent, tech, and tier 2 growth: In this new era, hospitality is no longer just about transactions; it’s about transformation. Success will belong to those who reimagine the sector as a platform for meaningful engagement, driven by innovation and powered by a young, dynamic workforce.Read here

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.