CAGR Insights is a weekly newsletter full of insights from around the world of the web.

Chart Ki Baat

Gyaan Ki Baat

Diversification Isn’t Just a Numbers Game

Owning ten mutual funds doesn’t mean you’re diversified. It just means you own ten mutual funds. The real question is—what’s inside them?

Sameer, like many educated investors, thought his portfolio was balanced: no direct stocks, no rash bets, just a clean selection of top-rated mutual funds. But a lazy weekend audit opened his eyes. The same five stocks—HDFC Bank, Reliance, ICICI Bank—popped up across multiple schemes. Different wrappers, same contents.

What looked like diversification was duplication.

Here’s the kicker: mutual funds don’t operate in isolation. Many fund managers chase the same market darlings. So, when you spread your money across schemes, you might just be stacking more of the same risk.

And it’s not just about domestic overlap. Some funds sneak in international exposure too—without you even realising. One Sameer-owned fund had Swiss chocolates; another had American chips—tech chips, not potato ones.

Lesson? You can’t diversify by delegation alone. You must look under the hood. Read the fund factsheet. Study the top holdings. Understand sector and geographical exposure.

Because real diversification isn’t owning more—it’s owning different.

So don’t be dazzled by variety in fund names. Be alert to similarity in their guts. The portfolio that feels safe might actually be fragile.

Stop confusing volume with wisdom.

Start investing with your eyes open.

Personal Finance

- When will salaried employees get Form 16 to file income tax return for FY 2024-25 (AY 2025-26)? Form 16, a crucial TDS certificate for salaried employees, must be issued by June 15 if tax was deducted. While not mandatory without TDS, it eases ITR filing. Employees can’t download it—only employers can issue it via the TRACES portal.Read here

- Why has insurer denied death claim in father’s debit card? Many debit cards offer accidental death insurance, but claims are denied if no qualifying purchase transaction occurred within 90 days. ATM withdrawals and UPI don’t count. Always check terms—lack of clarity often leads to unfortunate claim rejections.Read here

- How the proposed 3.5% US remittance tax could hit savings for NRIs, visa holders: A new 3.5% US excise tax on remittances by non-citizens could begin January 2026, impacting H-1B, F-1, and green card holders. Each transfer abroad may cost more, urging immigrants to rethink financial strategies and remittance timing. Read here

Investing

- SEBI notifies new F&O rules: What investors need to know about new derivative trading limits: SEBI revamps F&O rules, linking position limits to stock free float and delivery volume to curb frequent bans. Index option limits are raised, intra-day monitoring begins, and a pre-open session is introduced to boost transparency and price discovery. Read here

- Why You Don’t Lose Money in Bonds (If You Wait Long Enough): Bond losses are often misunderstood. If held to maturity, individual bonds guarantee nominal returns despite interest rate changes. Bond funds, however, reset duration daily, exposing investors to ongoing rate risk. For safety, choose short-duration bonds—or simply wait it out. Read here

Economy & Sector

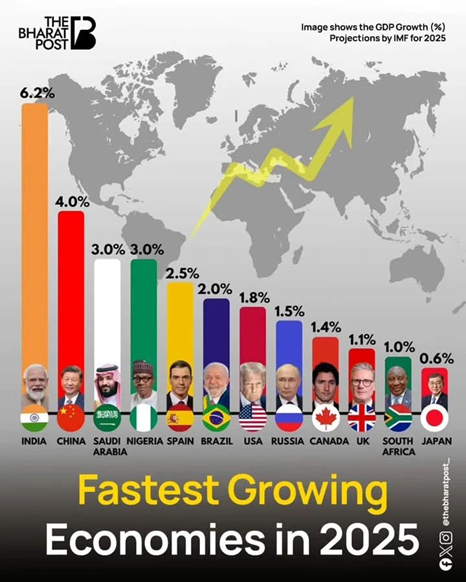

- India is set to be the world’s fourth-largest economy — but sustained growth will warrant more reforms: India is set to become the world’s fourth-largest economy, driven by a young population, rising consumption, and growing tech and manufacturing sectors. However, challenges like infrastructure gaps, slow reforms, and income disparity must be addressed to sustain long-term growth. Read here

- Finance Ministry instructs RBI to ensure gold loan rules do not adversely impact small borrowers: The Ministry of Finance urged RBI to ensure new gold loan rules don’t hurt small borrowers, recommending implementation from January 2026. It suggested excluding loans below ₹2 lakh and addressed concerns about loan-to-value limits and borrower documentation, following Tamil Nadu CM’s objections. Read here

- India-US trade deal nears the finish line—final talks are set for early June: India and the US aim to finalize a bilateral trade deal by late June, addressing tariffs and strategic interests. Negotiations focus on complementary strengths, opening sectors, and boosting trade amid shifting global dynamics, with India poised as a key market and producer. Read here

****

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.