Debt funds are good investment vehicles to protect your capital and still earn more than your bank interest, but they may not sufficient to help you generate enough wealth to achieve financial independence.

Let us understand this by an example.

Assumptions:

- A 30-year-old salaried employee has a current monthly income of INR 1.5 Lacs

- Annual Salary increment: 8%

- Annual Expenses: INR 1.15 lacs (Rent: 60K, Grocery: 20K, Child Education: 20K, Medical: 5K and Travel: 10K). The inflation rate for each is as follows: Grocery: 6% | Rental: 10% | Medical: 12% | Education: 10%

- The balance is saved in a combination of debt instruments which give the returns as follows: PPF: 7.6% | Bank Savings: 3.5% | Debt Funds: 7.0%

- The weighted average rate of return is around 6.7% annually

- Annual compounding of returns assumed

- Assumed no taxes on gains on investment

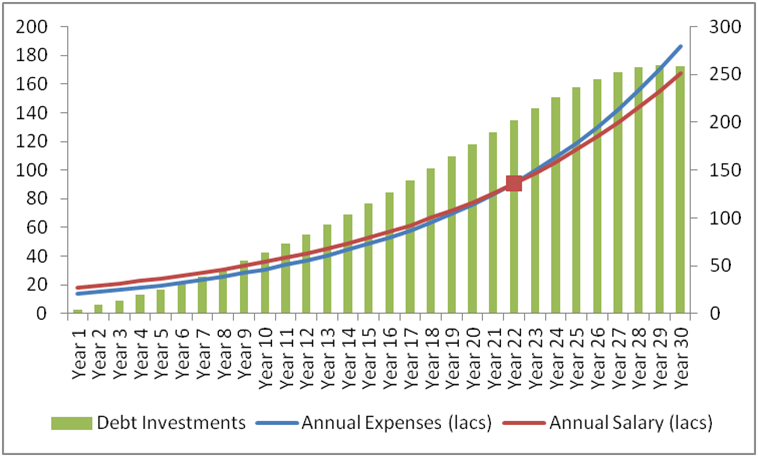

So let us see how your expenses increase for the next 30 years vis-à-vis your debt investments.

As you can see, your expenses will outlive your income from Year 22 onwards and that is when you will start dipping into your debt savings which will start declining thereon. And this happens while you are still working. You can well imagine what should happen once your recurring income drops or becomes negligible post your retirement.

We often ignore the impact of inflation on our lives and hence, the above is a very common “kahaani ghar ghar ki”. Therefore, even in the best case scenario, debt funds will perhaps help us match inflation but not create additional wealth that can make us live through our retirement comfortably. And this is the reason the majority of retired or nearly retired Indians are working out of compulsion. A lot of such people would have ideally wanted to spend their time reading or travelling or just basking under the sun on a chilly winter morning. But even after 40 years of working, they are striving to make ends meet just because our normal income flow cannot live up to the increase in expenses.

We, therefore, need to invest our savings in instruments which can considerably beat inflation. This is where equity comes into play. You may not like it but you may still have to consider it for a comfortable future. However, equity is a challenging subject for most and we tend to have an increased the fear of loss because of our own lack of understanding of which funds to invest in. Therefore, for a person who is new to equity investing, choosing the SIP mode of investing through a trusted advisor is the best route to choose.

But then why do people still invest in Debt? And where exactly should you be investing? Read here to find more.