Investors are just humans and every human is a different personality. And hence, our appetite to be able to see our money go up and down might vary as well. And what we want to do with our money is a very personal decision. So it is perfectly okay if you are an investor who hates to witness the volatility that equities bring on the table. This means, that you prefer certainty in life more than the worry about whether your negative return will turn positive ever again. Basically, you are a debt investor.

Saying no to equities is fine, as long as you know the trade-offs.

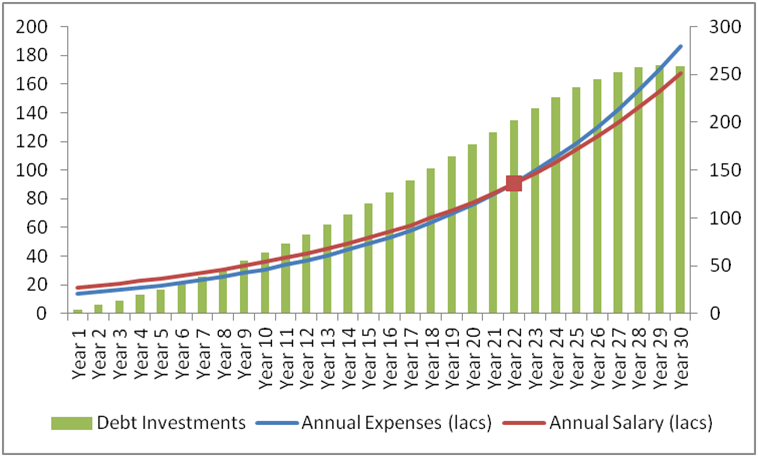

- Your returns will at best match inflation, debt instruments are unlikely to give you inflation-beating returns now and forever

- Hence, to accumulate the amount of corpus that you may need for financial independence may necessitate you to earn more as your invested money can only work to protect your capital (in the best case scenario)

- Debt Mutual Funds can also suffer losses in rare cases. This generally happens with funds which have high credit risk on their portfolio

But Debt Funds do come with advantages that are more in sync with your investment philosophy:

- Returns are fairly consistent (The degree of volatility is much lower than equity)

- Depending on the funds you select, you can have complete liquidity of capital. So you can withdraw whenever you want without any charges

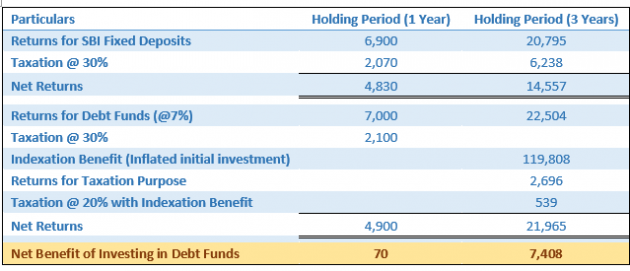

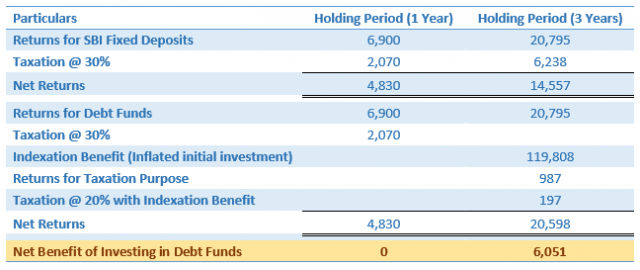

- Debt FMPs or Fixed Maturity Products which have around 3-year lock-in, provide slightly higher returns than other debt funds which do not have a lock-in. Add to that the benefit of low or negligible taxation due to indexation benefits.

At this juncture, you might be quite disappointed with the fact that there could be losses in rare situations and you still don’t get to escape volatility. You must be telling yourself a 100 times that the good old FDs are still the best solution. But hold on. Is your Fixed Deposit making you wealthier? Read here to find out.