CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 24-Mar-23 | 17-Mar-23 | Change |

| Nifty 50 | 16,945 | 17,100 | -0.91% |

| Nifty 500 | 14,279 | 14,421 | -0.98% |

| Nifty Midcap 50 | 8,284 | 8,488 | -2.40% |

| Nifty Smallcap 100 | 8,924 | 9,095 | -1.88% |

Chart Ki Baat

Gyaan Ki Baat

Mutual Fund levy exit load on most of the funds, if the redemptions are placed before the stipulated time. It is a kind of penalty for premature redemptions.

As Mutual funds are market-linked, regulators want investors to make investments for a longer period and discourage early redemption. Exit load is applicable on the redemption value calculated based on NAV as of the date of redemption.

Note: The exit load is paid to AMC, which is again reinvested in the investment portfolio as per SEBI guidelines. Hence existing investors get the benefit of outgoing investors.

Here’s the list of curated readings for you this week:

Personal Finance

- The rare and unexpected occur more often than you think. – In some respects, it feels like we’re living through a period of elevated volatility in geopolitics, markets and the economy. But as someone who enjoys reading about financial market history I can attest that this is the norm. History is chock-full of panics, crises, crashes, ups, downs and the unexpected. Read here.

- NPS Tier 2 vs mutual funds – Comparing the two on performance, cost, taxes and other important parameters. Read here.

Investing

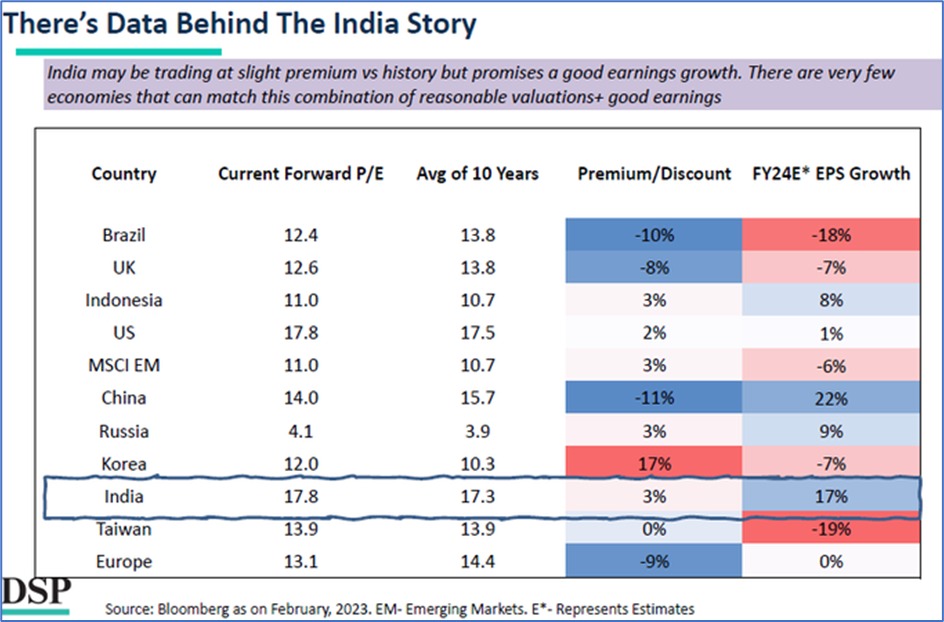

- India Valuations: There are pockets of opportunity – The NIFTY 50 Index is on 18th month of consolidation. Ever since high of October 2021, earnings have risen, and valuations have normalized. Read here

- Decoding Plastic Pipe Industry in India – In this video, PPFAS fund manager talks about various product categories as well as the major players & their strategies. He also talks about what can be the competitive advantages for any player in the industry. Watch here

- Hindustan zinc cash being depleted for Parent company – Hindustan Zinc has paid Rs 20,710 crore as dividend to Vedanta in this financial year, significantly higher than its nine-month profit of Rs 7,928 crore. Read here.

Economy

- Switzerland’s secretive Credit Suisse rescue rocks global finance- In the end, the Swiss agreed, choosing to wipe out 16 billion of francs of bonds, compensating shareholders with 3 billion francs and turning a key principle of bank funding on its head – namely, that shareholders rather than bondholders take the first hit from a bank failure. Read here

- Steel Industry may have a over capacity problem if projects are completed – In steel, there are 347 projects that aim to set up 239 million tonnes of additional capacity. This is more than 1.5 times the current outstanding capacity. Upon completion these alone could raise the steel capacity by almost 50 per cent. Read here.

- How did Taiwan’s Govt increase its tax collection by 75% in a single year? – No crackdown. No tax rate hikes. No one time levy. So, you’re wondering how? They launched the “Uniform Invoice Lottery” scheme to gamify tax collection. Read twitter thread here

CAGR Speak

- The importance of Brand Building for companies – The profit growth for Pipe companies who have invested in building brands over the years is higher than the other players, even at similar pace of revenue growth. Read here.

- Is your Bank RM asking you to buy a Insurance policy for tax benefit ? Think Again – Read here.

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you’d like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.