CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 31-Mar-23 | 24-Mar-23 | Change |

| Nifty 50 | 17,360 | 16,945 | 2.45% |

| Nifty 500 | 14,558 | 14,279 | 1.95% |

| Nifty Midcap 50 | 8,467 | 8,284 | 2.21% |

| Nifty Smallcap 100 | 8,995 | 8,924 | 0.80% |

Chart Ki Baat

Gyaan Ki Baat

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a pure term life insurance scheme launched by Government of India directed towards the poor and low-income sector of the society.

- Eligibility – The entry age for this scheme is 18-50 years and the interested policyholder must have an active savings bank account.

- Premium – Rs 436 per annum. The premium paid is applicable for tax exemption under section 80 C. The premium may be lower if you are joining the scheme mid-year.

- Coverage – In case of Death, beneficiary receives is Rs. 2 Lakh. No maturity benefit or surrender benefit with this policy. The coverage amount to the beneficiary is tax free. The cover shall be for one year starting from June 1 to May 31 of next year and the insurance holder can renew the scheme up to 55 years of age.

This can be a useful government policy for low-income individuals around us. Do spread the word.

Here’s the list of curated readings for you this week:

Personal Finance

- Product-wise insurance commission cap removed by IRDAI- The new rules, which aim to provide flexibility to the insurers to manage their expenses and are set to come into effect from April 1, will allow insurance companies to offer commission up to the expenses of management (EoM) limit. Read here.

- Concentration is Not Your Friend – The financial graveyard of history is filled with concentrated investors. In particular, going from a 1-stock portfolio to a 5-stock portfolio cuts the standard deviation in half, and going from a 5-stock portfolio to a 50-stock portfolio reduces the standard deviation by another 40%. Read here.

Investing

- Stocks Ki Baat – Shivalik Bimetal Controls Limited – We talk about a dominant player in niche industries of Shunt Resistors and Thermostatic Bi-metals. The application of its products in smart meters and EV are expected to be a promising growth area for this company. The stock has more than doubled its revenue and profit has also become 4x since FY18. Read thread here

- The IPO rush: Lessons from the past – The probability or chances of gaining more than the index, only by investing in IPOs, is very less. One can choose to play the listing day game – applying and selling on listing day at a premium. Read here

- What they don’t tell you about high P/E stocks – The probability or chances of gaining more than the index, only by investing in IPOs, is very less. One can choose to play the listing day game – applying and selling on listing day at a premium. Read here

- How to Identify Promoters extracting money via high salaries –P/E multiples are deceptively damaging for anyone seeking long term gains from equity investments. Marcellus says, Focus on high quality compounders, rather than agonise about high P/E. Read here

- Indian promoters are best contrarians – are they buying Now? – The data show that owners/promoters usually have a huge skin in the game and it is the interest of investors to track promoter share transaction activity, especially where there is a pattern of buying. Read here.

Economy

- NBFCs are increasingly taking credit from banks- The banks’ outstanding credit to NBFCs has risen nearly 1.5x since February 2020. The banks’ credit exposure to NBFCs had crossed crucial thresholds in CY2022. The growth has remained robust due to high growth in the NBFC asset book and as additional borrowings moved to banks due to differentials between market yields and interest rates offered by banks and lower borrowings in the overseas market. Read here

- Why isn’t the whole world rich? – The question of why some countries join the developed world while others remain in poverty has vexed economists for decades. What makes it so hard to answer?. Read here.

CAGR Speak

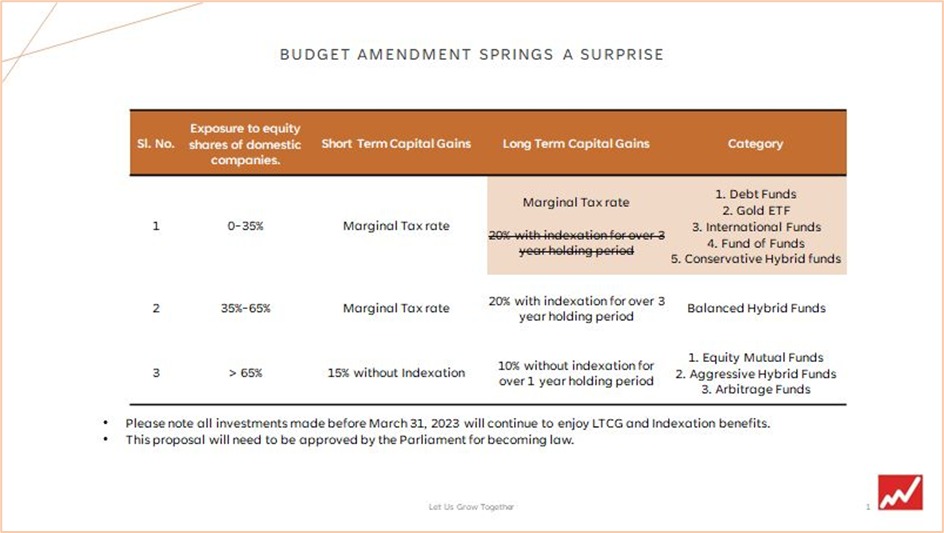

- An MF category is being killed. – This means that debt MF will have taxation at par with Bank FDs. This is a big blow to the growth of the Debt MF among retail investors. Read here.

- How many of you have lost money in Real Estate? A lot of people I know who have invested in residential real estate in the last 7-8 years, have not seen much appreciation. Read here.

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.