CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 12-May-23 | 5-May-23 | Change |

| Nifty 50 | 18,314 | 18,067 | 1.37% |

| Nifty 500 | 15,477 | 15,277 | 1.31% |

| Nifty Midcap 50 | 9,149 | 9,035 | 1.26% |

| Nifty Smallcap 100 | 9,807 | 9,733 | 0.76% |

Chart Ki Baat

Bazaar Ki Baat

A striking pattern – Buying right, but selling wrong.

In the 7th edition of the “Bazaar Ki Baat” series, we discuss a recent study that captures a striking pattern in the investment world – while Investors display clear skill in buying, their selling decisions underperform substantially.

We also talk about what led to the sharp rally in the Indian equity market in April.

Further, we show that even after the changes in debt tax rules, how debt funds score over FDs due to the deferment of taxes.

Do watch and follow our channel

Here’s the list of curated readings for you this week:

Personal Finance

- How an obscure PPFAS morphed into India’s Berkshire Hathaway– ‘The way of the tortoise’ has seen the fund house grow 200 times its size and deliver a stunning 19% CAGR. Read here.

- Finance is like fashion – Wait long enough and the same arguments come back in style. Read here.

- Shruti shares her experience of interactions with millennials regarding their investment journey. Read here.

- A vicious trap – Dig into any successful business and you’ll likely find two people: One who comes up with crazy ideas, and another who kills most of those ideas while giving the sensible ones a shot. Read here.

- How investible is the Electrification theme? – Close to 50% of the power being used by Industries across India is being served by captive power. Watch here

- An investor’s edge – There are three competitive advantages as an investor: informational, analytical, and psychological. Of the three, only analytical and psychological are sustainable. Read here

- Culture eats everything for breakfast – HDFC Bank CEO – The crux of our story is that we had a strategy which can be copied by anyone. We have a great set of people, which anyone can poach. We have technology, which people can buy, okay? But there is a certain culture which is unique to HDFC Bank. Culture which no one can replicate. That’s our execution capability. And that is what differentiates us from everyone else. Read here

Economy

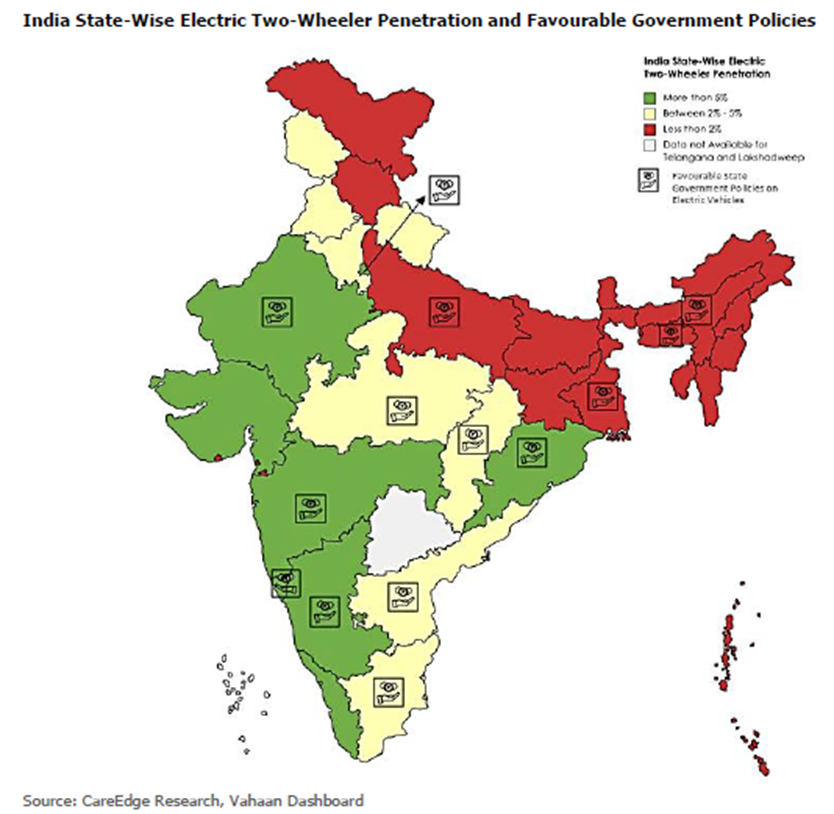

- Electric 2 wheelers leading the growth of EV in India, but infrastructure gap remains. – E2W sales grew by 188% in FY23 as compared to the previous year FY22.As of January 2023, India had 5,254 public electric vehicle (EV) charging stations, to cater to a total of 20.65 lakh EVs Read here.

- Source says Credit Suisse India FX ops shut – Credit Suisse has shut foreign exchange operations in India, but other proprietary trading and client services have remained unaffected in the wake of its sale to UBS, an official familiar with the situation said. Read here.

- Rs. 25 for a veg thali and Rs. 58 for a nonveg thali in India – An interesting indicator from CRISIL on the cost of Thali in India. Read here.

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.