CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 16-Jun-23 | 09-Jun-23 | Change |

| Nifty 50 | 18,826 | 18,563 | 1.42% |

| Nifty 500 | 16,181 | 15,877 | 1.92% |

| Nifty Midcap 50 | 9,884 | 9,599 | 2.97% |

| Nifty Smallcap 100 | 10,741 | 10,443 | 2.85% |

Chart Ki Baat

Gyaan Ki Baat

Convertible & Non-convertible debentures (NCDs) are issued by the companies to raise funds from investors.

Convertible debenture holder has the option of converting the debenture to the share of the issuing company. This option is not provided in non-convertible debentures. These debentures can either be secured (backed with a company asset) or unsecured (not backed with any asset).

The substitute for Debentures is fixed deposit but generally Debenture provides a higher rate of interest than FD and they have much higher credit risk than bank fixed deposits.

For example, IIFL Finance NCD of 5yr tenor is being issued with a coupon rate of 9%.

CAGR RISE

Last Thursday, Shruti and I conducted an informative and engaging educational corporate workshop for the employees at Sun Pharmaceuticals in Mumbai as part of our CAGR RISE initiative. Read here

Conducting these sessions and spreading financial awareness is a passion project for us. It gives us a sense of fulfillment even if the attendees end up being 1% better at their finances.

We curate and customize the content closely with the HR/Admin team to ensure that we only focus on topics that add value. For every corporate, we have a customized session. So far, we have conducted over 100+ sessions.

If you believe your colleagues can benefit from such a workshop, do help us to connect with the right person in your organization.

Here’s the list of curated readings for you this week:

Personal Finance

- RBI has announced the first tranche of Sovereign Gold bonds (SGBs) for FY2023-24. Issue Period: June 19 – June 23, 2023.- It is a wonderful product for investors looking to take exposure to gold as a diversification tool. Reach out to us if you are interested to invest. Read here.

- SEBI acting against unregistered advisory services – Over Rs 12-crore earnings from unregistered advisory services impounded, and three entities banned. Read here.

- Does your mutual fund portfolio have many large-cap active funds⁉– Recently, I read an interesting research paper on the Mutual fund space in India. The paper clearly finds out that holding more than one active large-cap mutual fund does not add any diversification benefit to a client’s account. Read here.

- Over 65% of partial NPS withdrawals are for residential property – Of the total 4.87 lakh partial withdrawal cases reported in FY 2022-23, 3.25 lakh are towards the purchase or construction of residential property. Read here.

- What % of my salary income should I invest in mutual funds? There are several thumb rules around how much we should save and spend. But I am not a big fan of thumb rules.

There are no right and wrong answers to these questions. And every single person needs to find their own sweet spot. Read here.

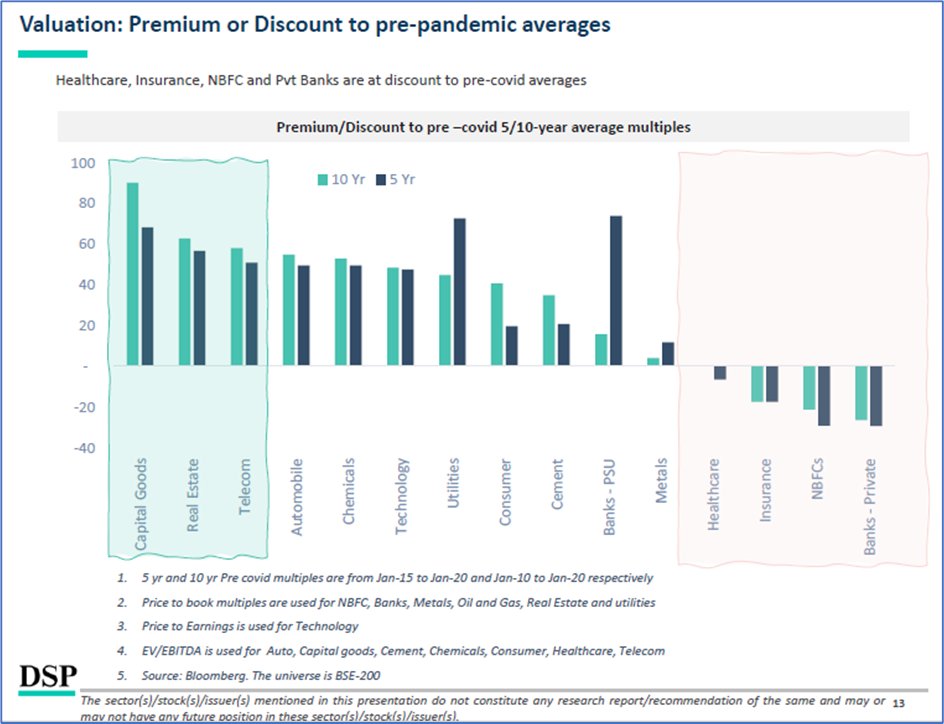

- Must read – FY23 Report Card of India Inc. – Nifty-500 ex-financials: 24% inflation driven revenue growth in FY23, 12% CAGR FY19-23. EBITDA margins have declined from FY22 peaks, returning to pre-pandemic levels. Balance sheet leverage slightly worsened, ROE down from FY22 peak but still >15% excluding commodities (+300 bps vs. FY19) Read here

- Big Tech and the costs of “Dreamy Business”– Meta has spent approximately $56B on its Reality Labs division since 2012 and through Q2 2023. As Amazon Fouder Bezos wrote “ “As a company grows, everything needs to scale, including the size of your failed experiments. If the size of your failures isn’t growing, you’re not going to be inventing at a size that can actually move the needle.” Read here.

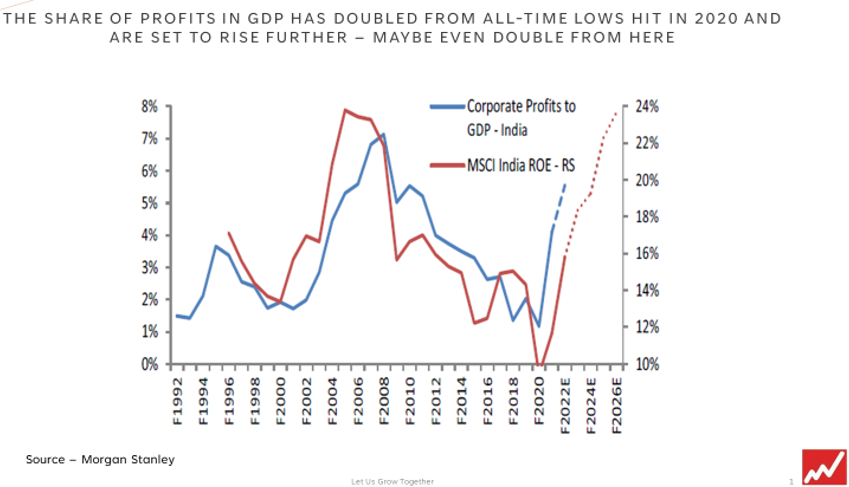

- India’s capital-output ratio is among the most efficient in the World. A lower capital-output ratio is desirable as it shows capital efficiency. India has the lowest capital-output ratios compared to most emerging/developed economies. As a result, India has consistently created vast amounts of profit pools in every industry over many years. The importance of such sustainability in growth, re-investment, and development cannot be overestimated. Read here

- Prashant Jain talks about what it takes to consistently beat the market – We are all limited by our understanding of the future. But when you find good quality companies which are unreasonably expensive, the discipline is to just not participate. Read here

Economy

- India’s CPI Inflation Falls To 25-Month Low in May – The consumer price index-based inflation stood at 4.25% in May, as compared with 4.7% in April. Read here

- Inflation seems to be the best determinant of bond yield movement. – The rise in bond yields since 2020 has been in line with the inflation rise in most Asian countries. Read here.

- Apple May Shift Nearly 18% Of iPhone Production To India By 2025: BofA Securities – iPhone manufacturing in India was nil before the PLI scheme was introduced in 2020 and stood at 7% in the fiscal ended March 31, 2023, according to a BofA Securities report Read here.

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.