CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 21-Apr-23 | 13-Apr-23 | Change |

| Nifty 50 | 17,624 | 17,828 | -1.14% |

| Nifty 500 | 14,847 | 14,954 | -0.72% |

| Nifty Midcap 50 | 8,731 | 8,677 | 0.62% |

| Nifty Smallcap 100 | 9,369 | 9,337 | 0.34% |

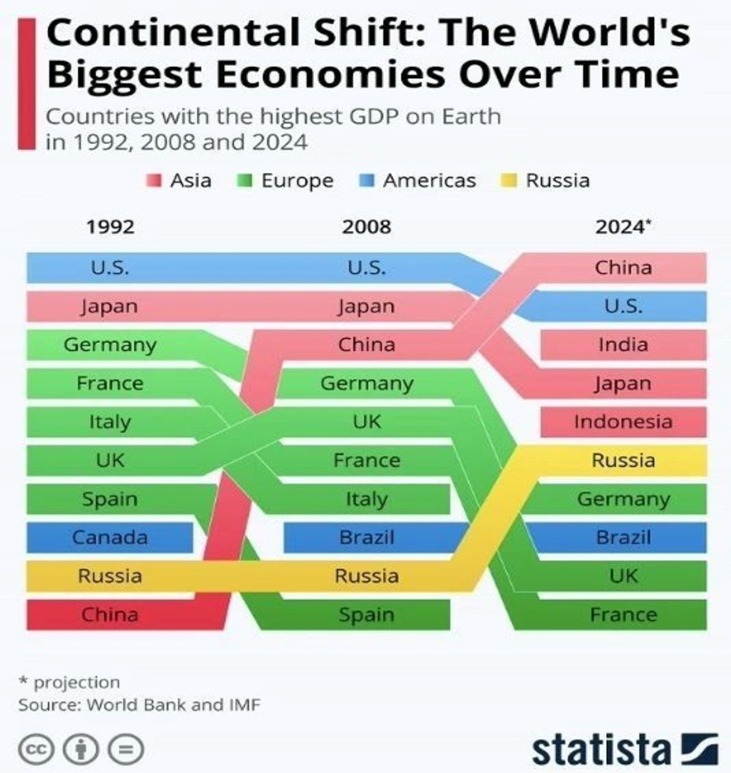

Chart Ki Baat

Gyaan Ki Baat

NASDAQ (National Association of Securities Dealers Automated Quotations) is an American securities exchange having headquarters at New York, USA.

NASDAQ 100 is a large-cap index focusing on modern industry and technology companies like Apple, Google, Amazon etc, it does not include financial companies.

Indian investors can take exposure via Nasdaq ETFs or Funds of funds and have good diversification in portfolios. These invest in companies that are new aged and have the potential for high growth and at the same time disruptive in nature.

Here’s the list of curated readings for you this week:

Personal Finance

- The average equity investor outperformed their investments in 2022 – We believe this is primarily due to investors continuing to invest with their SIPs despite turbulent market conditions, which helped with rupee cost averaging. Read here

- Was taxation rule the only driving factor of investing in international funds for Indian investors? – The good news is that a recent study highlights that international diversification can protect investor portfolios over longer horizons against prolonged periods of underperformance by Indian markets. Read here.

- Greatness isn’t always rainbows and butterflies – To be disciplined is to resist your short-term emotional whims in service of your long-term goals. Let everlasting love triumph over the temptress of temporary hate. Read here

- Did you choose your mutual funds based on the ranking of a particular platform? – But is the rating/ranking a sufficient measure to select your funds? Largely yes, but it is good to be aware of how these rankings work and what are we missing when we use these rankings. Read here

Investing

- Masterclass in Factor Investing: Quant – From Fundamental Practitioner Lens – Man + Machine can be better than Machine or Man. Watch here

- How to evaluate PSU companies? – PPFAS Mutual Fund CIO, Rajeev Thakkar walks us through various aspects while studying government-owned businesses in India. Watch here

- Continue investing in Duration – DSP MF says yields have fallen, yet there is a long way to go. The cut cycle has just begun. Read here

- The role of REITs in asset allocation – REITs offer an expanded opportunity set, providing diversified sector exposures at smaller capital outlays. REITs allow for efficient and timely capital deployment, to both complement and temporarily substitute private real estate. Read here.

Economy

- India Races to Get Rich Before It Gets Old as Population Passes China – Bloomberg Economics says India needs to advance on four broad fronts — urbanization, infrastructure, up-skilling and broadening its labor force, and boosting manufacturing — to fully cash in on its demographic dividend and reshape the global economy in the process. Read here

- Why Researchers differ on India’s poverty rate- All [research papers] show that poverty has plummeted after the economic reforms of 1991 that helped accelerate GDP growth. Clearly fast growth is the best poverty alleviator. Read here

- States dragging feet on capex despite funds– A push by the Centre notwithstanding, states continue to tread slowly in terms of capital expenditure, with 24 large states spending only 55.1% of their 2022-23 (Apr-Mar) Budget target as of February-end. Read here

- Is US banking crisis really over? – Currently, capital is fleeing the banking system, exacerbating the liquidity problem and causing even more problems for the banking sector. Read here

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.