CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 9-Jun-23 | 2-Jun-23 | Change |

| Nifty 50 | 18,563 | 18,534 | 0.16% |

| Nifty 500 | 15,877 | 15,811 | 0.42% |

| Nifty Midcap 50 | 9,599 | 9,630 | -0.32% |

| Nifty Smallcap 100 | 10,443 | 10,321 | 1.18% |

Chart Ki Baat

Bazaar Ki Baat

In the 8th edition of Bazaar Ki Baat, we discuss the reasons for market rally in May and we review the Q4FY23 earnings.

We also discuss the insights earning growth data for various sectors over the years.

1. The rise and rise of banking – The profit growth of NIFTY 50 Banking companies has 896 to 2128, from FY20 to FY23, now contributing close to 34% of NIFTY company earnings.

2. Oil & Gas– This continues to be an important sector. But this year we see earnings slowing down

3. Cyclicality of certain sectors – Automobiles, Metals and Oil and Gas are some of the prime examples, this chart beautifully showcases that. Especially for metals.

4. Defensive sectors – Consumer and Technology, you can see the stable growth showcased by these sectors.

5. Telecom – The sector seems to be stabilizing as there seems to be two clear winners in Jio and Airtel of price war started by Jio. Both have grown by eating up share from the other players namely VI.

We also discuss the ideal cover and ideal age for Term insurance.

Watch here and let us know your opinion in the comments.

Here’s the list of curated readings for you this week:

Personal Finance

- Launching CAGR NRI video Series – The part 1 of this series is an attempt to answer some of the most questions that NRIs have about money-related matters in India. Watch here.

- Impact of one fiasco in MF industry continues years after the incident – I was reading an earnings call transcript this morning and came across this commentary from management, it just struck me how a case of mismanagement can lead to clients exiting permanently from Industry. Read here.

- 101 women on leap.club recently told Shruti why they would want to exercise this option. Read here.

- Debt Funds – Life after removal of long-term indexation benefit – Now, the focus will be on returns and performance. This bodes well for debt fund investors. Read here.

- The Liabilities of Success – It’s easy to idolize the accomplishments of those who are more successful than you, but it’s hard to understand the price they paid for that success. Read here.

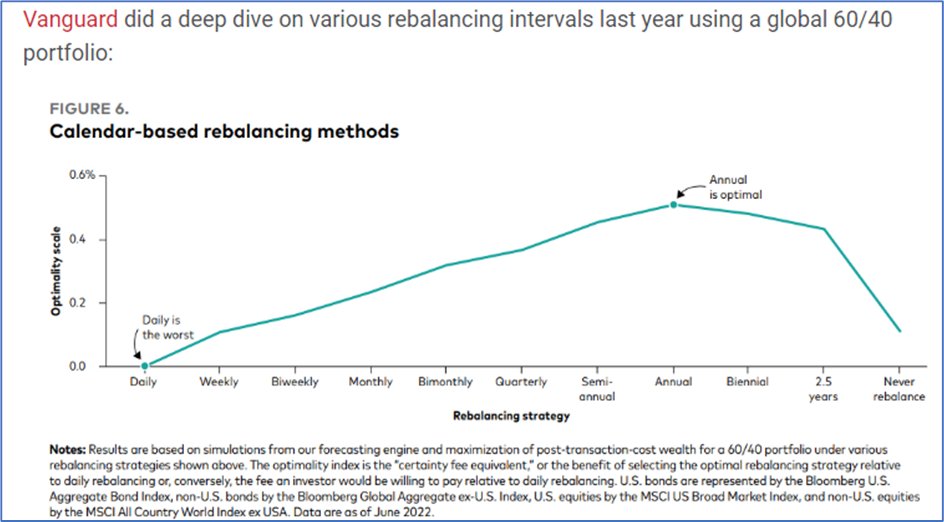

- The ideal rebalance frequency – If you’re not comfortable with a periodic-only rebalancing schedule, you could also do some sort of threshold levels where if an allocation gets too far out of whack then you rebalance back to target. Read here

- Net employee addition declined to almost zero in H2 FY2023 for ICRA’s IT sample companies-The net addition is negative in the last two quarters for the aggregate of top IT services companies because of moderation in demand coupled with an increase in the utilization of excess capacity added in FY2022 Read here.

- Why Jefferies Is Betting On India Hotels Sector – The operating margin of the Indian hotel industry neared its highest level in the fourth quarter of fiscal 2023 due to strong growth in average room rates and cost control, according to Jefferies. Read here

- ‘CA disappeared’: Listed company Milestone Furniture explains why it didn’t declare financial results: Milestone Furniture’s financial results for FY23 are in jeopardy as their chartered accountant (CA) has disappeared and refused to take their calls. The company is working to resolve the issue for BSE and ROC compliance. Read here

Economy

- Geography is destiny – Liberty is unlikely to plant itself in a land perpetually subject to invasion. This land’s residents cannot afford the luxury of liberty.Read here

- Reservoir storage remains above historical levels, auguring well for timely onset of kharif sowing – The levels remain comfortably above the historical average of the last 10 years (25% of FRL). Read here.

- India monsoon reaches Kerala after longest delay in four years- India received 57% less rainfall than average in the first week of June, weather office data showed on Wednesday, reflecting the delayed arrival of the wet weather. Read here.

- RBI Policy:Repo rate kept unch – The Reserve Bank of India’s Monetary Policy Committee today kept the policy repo rate unchanged at 6.50% and decided to remain focused on withdrawal of accommodation. Read here.

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.