CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 25-Jan-24 | 19-Jan-24 | Change |

| Nifty 50 | 21,378 | 21,639 | -1.21% |

| Nifty 500 | 19,410 | 19,615 | -1.04% |

| Nifty Midcap 50 | 13,250 | 13,473 | -1.65% |

| Nifty Smallcap 100 | 15,417 | 15,482 | -0.42% |

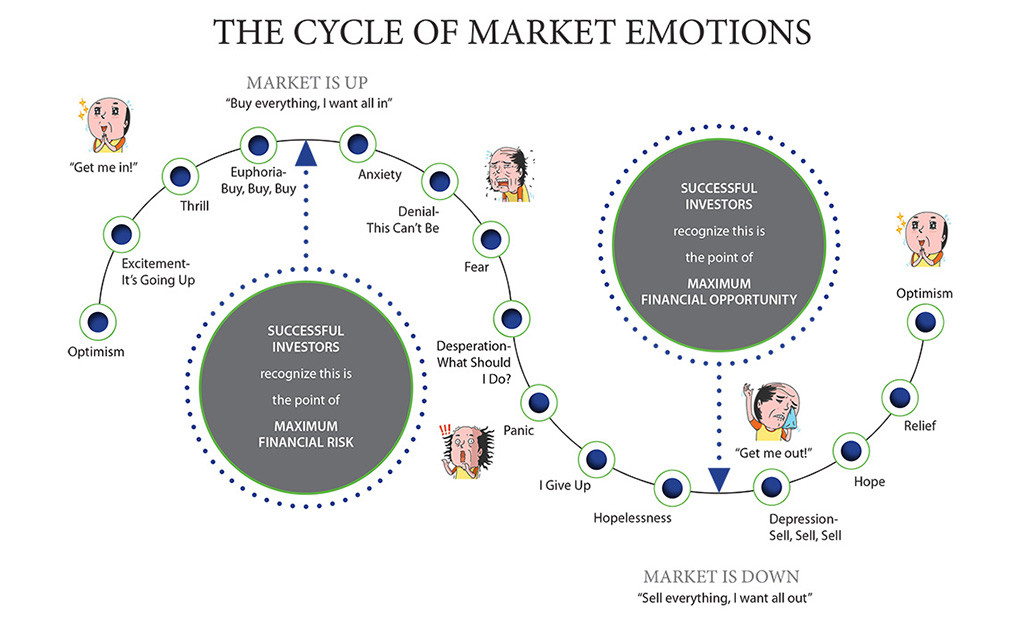

Chart Ki Baat

Gyaan Ki Baat

Covered Call Strategy

Mutual funds employ this strategy to earn premiums by selling call options on stocks they already own, enhancing their overall returns. In addition, it provides a degree of downside protection, as the premium received helps offset potential losses in the stock’s value.

For example, if an investor owns 100 shares of ABC stock trading at INR 100, they might sell one call option with a strike price of INR 105, receiving the premium. If the stock remains below INR 105 at expiration, the investor keeps the premium; if it rises above INR 105, they may have to sell the shares but still benefit from the premium.

Personal Finance

- Redefining Money Talks – Gen Z Embraces ‘Loud Budgeting’ Trend on Social Media, Opting for Financial Honesty and Frugality Over Flashy Displays. Read here.

- A Deep Dive into How David Perell Harnesses ChatGPT – David Perell leverages ChatGPT for deep textual analysis, decision-making, co-writing; showcasing the diverse applications of AI in his creative and educational pursuits. Read here.

- From Poverty to Prosperity – John Mackay’s journey from impoverished beginnings to becoming one of the world’s wealthiest men through perseverance, self-improvement, and a strategic move to the Comstock Lode during the Gold Rush Era. Read here.

- The Pitfalls of Shortcuts and the Value of Discipline – The article emphasizes the importance of avoiding shortcuts in business and personal finance, cautioning against the risks of neglecting crucial steps and the potential consequences, as highlighted through personal finance experiences. Read here.

Investing

- Exploring the Evaluation of Management in Companies – A Comprehensive Analysis of Promoter-Driven and Professionally-Managed Approaches. Read here.

- Zerodha Launches LIQUIDCASE India’s First ETF – The ETF, tracking the Nifty 1D Rate Index, provides returns similar to overnight mutual funds, surpassing savings account interest rates. Read here.

- Sebi’s FPI Guidelines: Clarity Emerges on Ownership Disclosures – Sebi’s FPI norms on additional disclosures see less immediate impact, with no urgent liquidation deadline for FPIs holding concentrated positions. Read here.

Economy

- Strong Performance and Optimistic Outlook for India’s Premium Hotel Industry – The Indian premium hotel industry is poised for strong performance in FY2024 with double-digit revenue growth, increased occupancy to 70-72%, driven by sustained demand from domestic traveland major events. Read here.

- Indian Insurers Introduce ‘Cashless Everywhere’ for Seamless Medical Claims Settlement – Allowing policyholders to access cashless medical facilities at any hospital, eliminating the need for reimbursement claims and enhancing the overall claims settlement process. Read here.

- Suez Canal Conflict Escalation – The escalation of the conflict in the Red Sea has led to a potential delays and higher freight costs, impacting sectors with import/export dependencies on these regions, such as chemicals, textiles, auto components, and pharmaceuticals. Read here.

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.