If you did your MBA from IIM Ahmedabad back in 2007, you probably paid somewhere around 4 lacs. Your younger sibling would have paid somewhere around 21 lacs this year. That is 4 times of what you must have paid and a staggering 23% annual increase in the fees.

If the cost of education rises at this pace, after around 18 years, your child will need a whopping Rs. 8.7 crores for the same program at IIM-A. Even at a 10% annual increase in cost, that amount would be close to Rs. 1.2 crores.

Education costs have been increasing at a rate higher than the usual inflation. And the same is true for elementary, primary and secondary education. Not to mention the additional cost of coaching that you have to incur at different stages of education. The above numbers clearly indicate a need to focus on how you intend to fund your child’s education.

This article seeks to help you formulate a plan for your child’s dream education no matter how old your child is.

For the sake of relevance, let us have 3 categories:

Category 1: If your child is under 10 years of age

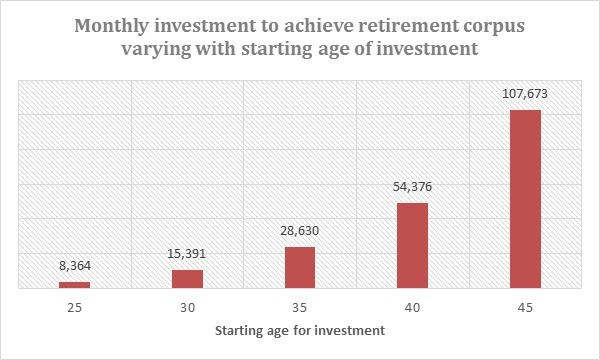

Your child in his early years of schooling and has a long way to go in terms of pursuing his education. Planning for children in this age bracket is the easiest simply because you have more time to save and invest. The earlier you start, the more corpus you create. Following are the 3 things you should be doing if you fall in this category:

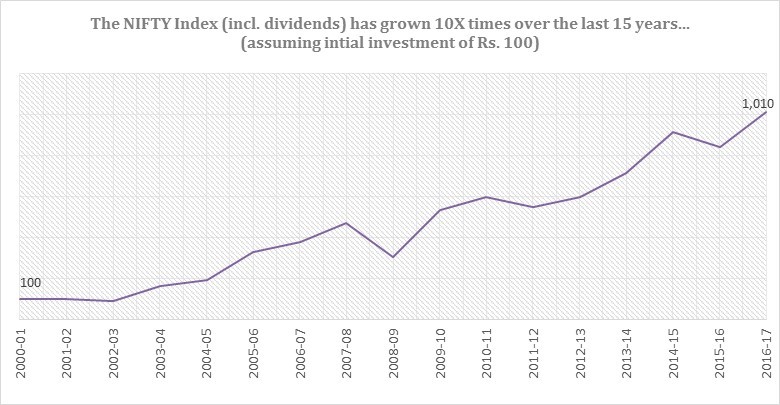

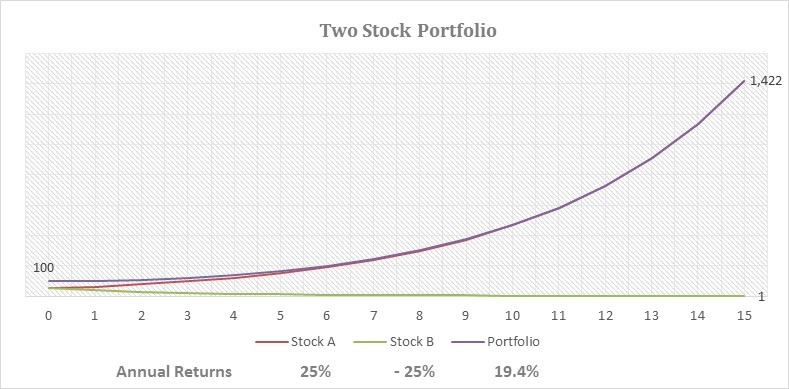

- Start a monthly SIP in a portfolio of mutual funds with predominant exposure towards equity. The time horizon is long term so you may have decent allocation towards mid and small cap funds, if you risk appetite permits that. This will enable you to create a substantial amount of wealth over the long run (Over 7 years).

- Every year, try and estimate the corpus you need to fund the education at both graduation and post – graduation stage. Accordingly, increase your monthly SIP every year to ensure that you are able to garner the required corpus. While SIPs in equity mutual funds will help you create wealth, increasing them every year will ensure that you don’t fall short of the amount you require.

- Park a small sum of money in a debt fund for any short term requirements. This will ensure that you have surplus funds available for any contingencies.

Category 2: If your child is between 10 – 15 years of age

Your child is probably nearing completion of school and will soon be ready for graduation years. This means that while you do still have time for post – graduation, you might not have enough time for saving to fund his graduation. Following are the 3 things that you should do:

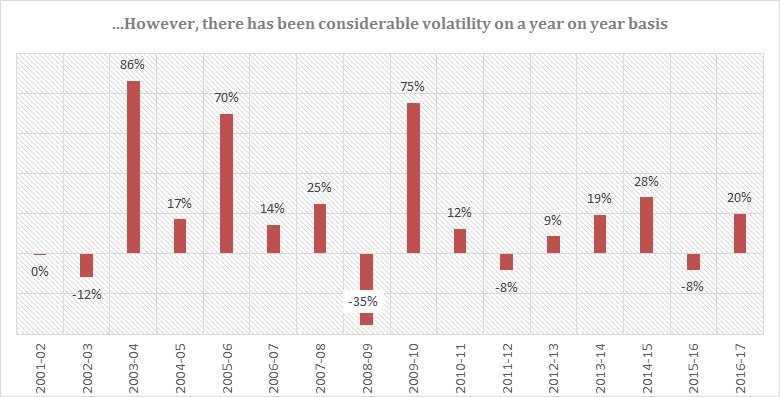

- Park your surplus money in a portfolio of debt equity funds. The split between the two categories will be determined by how many years are you still away from completion of school.

- Start a monthly SIP in a portfolio of mutual funds and asset allocation is key for such investments. You may keep an allocation of 30-40 percent in debt funds and the remaining exposure should be in a diversified basket of equity funds. The asset allocation should be monitored regularly and should be shifted entirely towards debt as you approach the time when you would need the fund. This will enable you to create a pool of wealth over the long run (Over 5 years).

- Increase your monthly SIP every year simply because you have relatively lesser amount of time to save for the post – graduation requirement.

Category 3: If your child is between 15 – 20 years of age

Your child has grown up is perhaps nearing his post – graduation years. As such you have only a few years before she completes graduation and goes for higher education. Here is what you should be doing:

- Park your surplus money in a portfolio of debt funds. The split between the two categories will be determined by how many years are you still away from completion of school / graduation.

- Start a monthly SIP in a portfolio of mutual funds and asset allocation is key for such investments. You may keep an allocation of 60-70 percent in debt funds remaining exposure should be in a diversified basket of balanced equity funds. The asset allocation should be monitored regularly and should be shifted entirely towards debt as you reach towards the year when the funds are required. However, your exposure should not include the risky category of mid and small cap funds.

- Increase your monthly SIP every year simply because you have relatively lesser amount of time to save for the post – graduation requirement.

At CAGRfunds, we help you estimate the amount of money you will require at every stage of education. We also help you define your most suitable portfolio. As you start investing, we ensure that our tools continue to review and re-balance your portfolio whenever the need arises.