CAGR Insights is a weekly newsletter full of insights from around the world of the web.

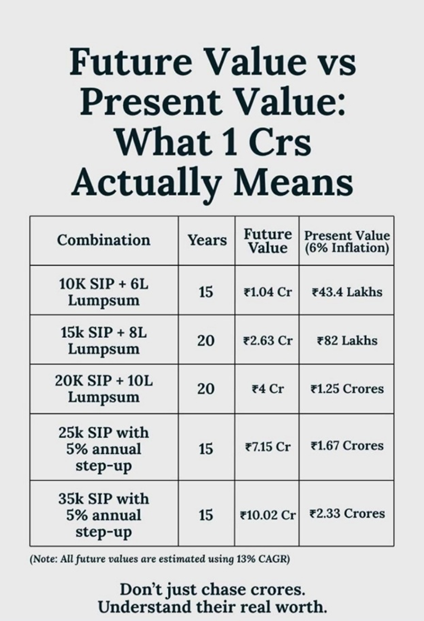

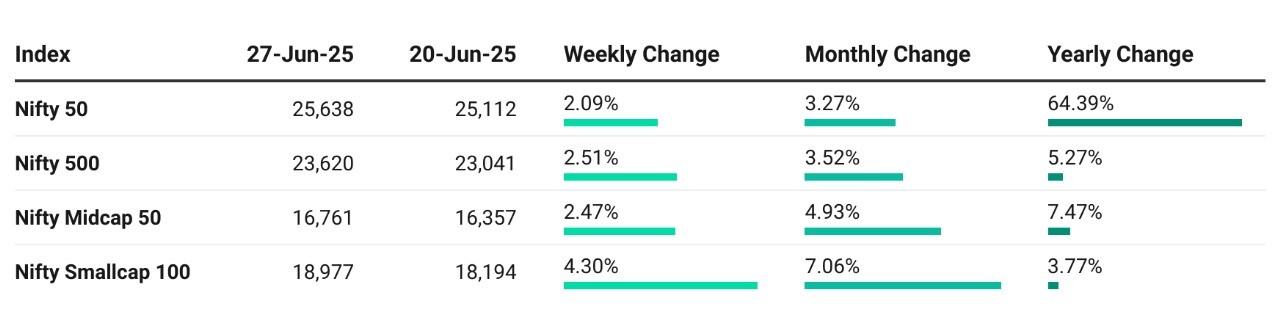

Chart Ki Baat

Gyaan Ki Baat

Rohan stared at his phone.

42 months. Rs 5,000 every single month.

His reward? A decent Rs 46,000 gain.

22% up — and yet, he felt let down.

Social media was full of SIPs turning into crores. His friend’s fixed deposit was outperforming. The hype didn’t match the reality.

He almost hit “Pause SIP.”

But then, he called his uncle — the man who had convinced him to start.

“Funny,” his uncle said. “I began mine in 1995. Same Rs 5,000/month. After 3.5 years, I was down 6.5%.”

Losing money. But he didn’t stop.

“Today,” he said, “that SIP is worth Rs 1.79 crore. I invested Rs 18.3 lakh. The rest? Pure compounding.”

And just like that, Rohan saw it.

The real wealth wasn’t in chasing big returns. It was in not quitting when things looked small.

Compounding starts like a rusted cycle — slow, boring, thankless.

But if you just keep pedalling, one day, it takes off like a rocket.

Don’t stop your SIP when it feels ordinary.

That’s exactly when extraordinary is quietly being built.

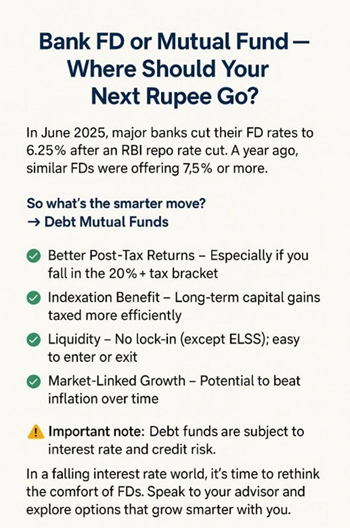

Personal Finance

- FDs Vs PPF: Does this still make sense to invest in fixed deposits? After RBI’s 100 bps repo rate cut in 2025, banks slashed FD rates. Top banks now offer 6.45–6.85% interest, while PPF remains steady at 7.1% tax-free. FDs lag in returns and tax benefits—choose wisely! Read here

- Creating an inheritance pot for the family: Turning ₹25L into a multi-generational legacy? This dad’s bold inheritance experiment skips strict goals and rebalancing rules—focusing instead on long-term compounding, smart fund choices, and financial wisdom for his kids. Curious how? Click to explore this inspiring plan! Read here

- DIY investing is rising — but you still need help with your money: Even the steadiest hands can shake when emotions are involved — just like Dr. Pavri in Munna Bhai MBBS. Managing money is no different. DIY finance is empowering, but expert advice can help avoid costly mistakes and steady your path. Read here

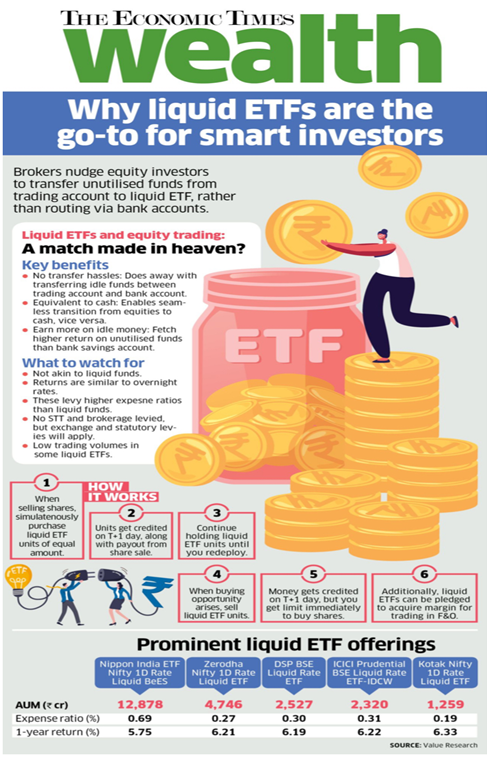

Investing

- Why asset allocation matters: From inflation to market swings, today’s investors face nonstop challenges. Enter multi-asset allocation—a smart mix of equity, debt, and gold that cushions risk and captures growth. Discover why this strategy wins the long game.Read here

- What’s Better Than U.S. Bonds for Downside Protection? Is U.S. bonds still your go-to for safety? Think again. From gold to global bonds, managed futures to tail risk funds—new tools offer smarter downside protection. But at what cost? Discover what really shields your portfolio when markets crash. Read here

Economy & Sector

- Why S&P Global thinks Indian economy will withstand West Asia turmoil: Despite ongoing West Asian tensions, S&P Global predicts no major impact on India’s currency or inflation. Lower oil prices and stable energy costs are providing a cushion. GDP growth is revised upward to 6.5%, with inflation expected near 4%. Read here

- India imposes anti-dumping duty on plastic machines from China, Taiwan: India has imposed anti-dumping duties of 27–63% on plastic processing machines from China and Taiwan to protect local manufacturers, following DGTR findings of unfair pricing and industry harm. Key global firms face steep penalties starting June 26, 2025. Read here

- India imposes anti-dumping duty on plastic machines from China, Taiwan: India has imposed anti-dumping duties of 27–63% on plastic processing machines from China and Taiwan to protect local manufacturers, following DGTR findings of unfair pricing and industry harm. Key global firms face steep penalties starting June 26, 2025. Read here

- India, US trade talks face roadblocks ahead of tariff deadline: Despite the impasse, Indian officials stress long-term commitment to the U.S. as a trusted economic partner, while maintaining policy independence. Read here

****

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.