CAGR Insights is a weekly newsletter full of insights from around the world of the web.

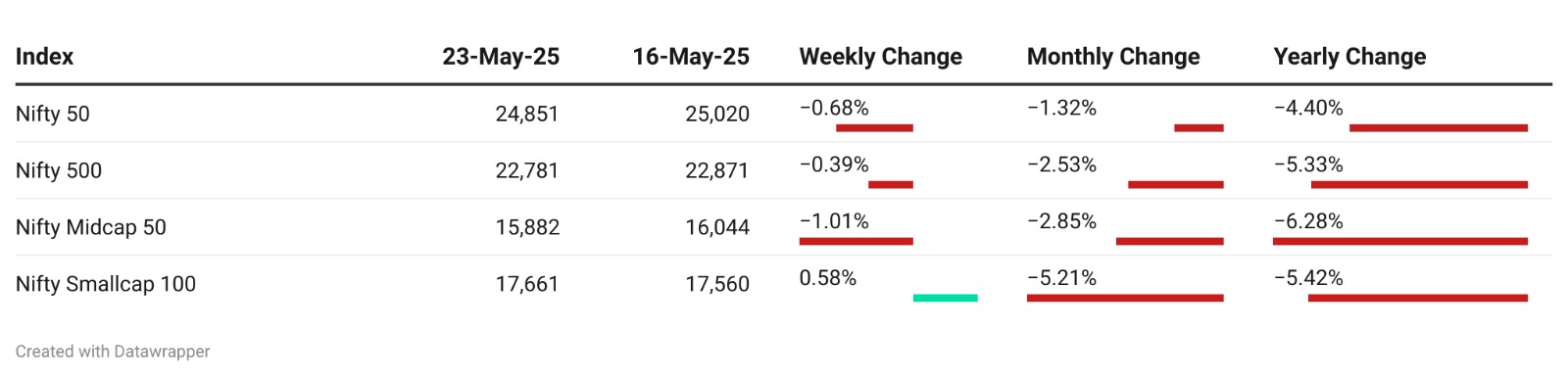

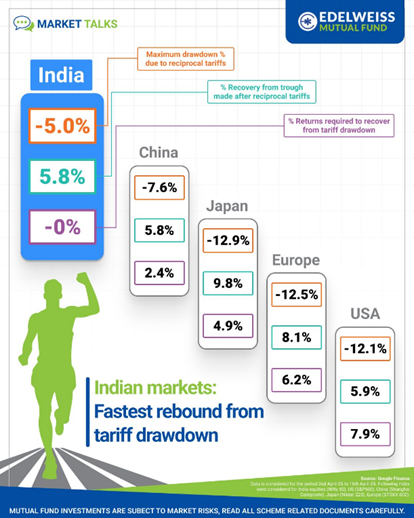

Chart Ki Baat

Gyaan Ki Baat

Let Go of the Losers, Not Just the Lovers

Your portfolio isn’t just numbers on a screen—it’s a diary of decisions, emotions, and sometimes, denial. We’ve all been there: clinging to that one stock that once made us feel like a market genius, even though it’s been bleeding red for months. Why do we hold on? The answer lies in behavioural finance, not spreadsheets.

Enter the Disposition Effect—our brain’s twisted way of locking in gains early and holding on to losses out of hope or pride. Add loss aversion to the mix (we hate losing money more than we enjoy making it), and suddenly that “potential comeback” stock becomes emotional baggage.

And it doesn’t stop there. Through mental accounting, we view each stock like a separate story arc: the hero, the underdog, the tragic flop. But portfolios should be more like playlists—cohesive, goal-driven, and periodically refreshed.

Here’s your action step: Run a quarterly “exit audit.” Strip away the nostalgia and evaluate each investment afresh. Ask: Would I buy this today? If not, it might be time to cut the cord.

In investing, as in life, sometimes the most powerful move is knowing when to walk away. Closure isn’t found in hope—it’s built through discipline.

Personal Finance

- 6 financial behaviours you should unlearn by 40: Ditch these 6 money habits by 40: save before you spend, talk openly about finances, don’t rely on one income, and stop thinking more pay or quick ownership equals success. Smart money moves now = lasting freedom later.Read here

- Warren Buffett’s 5 Frugal Spending Habits Everyone Should Copy: Warren Buffett proves that wealth is built by smart habits, not luxury. He still lives in the same house, buys used cars, clips coupons, avoids debt like the plague, and always saves before spending. These five habits show that frugality isn’t about deprivation—it’s about long-term freedom. Steal his strategy. Read here

- Instant loan for self-employed: All you need to know before borrowing via instant loan apps: If you are self-employed in India, getting a personal loan from a bank can be difficult. Freelancers, shop owners, consultants and gig workers often find it tough to get loans because their income is irregular and there is too much paperwork. Thankfully, instant loan apps are making it easier. Read here

Investing

- Lost Decades are Even Rarer Than You Think: Lost decades sound scary, but consistent investing over time (DCA) helps smooth the ride. Even during market slumps, most investors still beat inflation. History shows that staying the course with a balanced portfolio often wins—fear fades, but compounding endures. Read here

- Hidden cost of Fund of Funds that you should know before investing: Generally, when you invest in a mutual fund, the Total Expense Ratio (TER) is deducted from the fund’s assets. However, in the case of Fund of Funds (FoFs), you have to effectively pay for two types of expenses. Read here

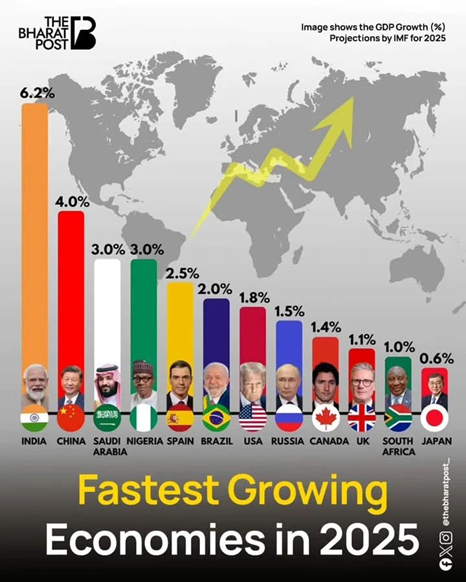

Economy & Sector

- India’s economic growth is not inclusive. It is a concentrated accumulation of wealth: India’s economic rise hides deep inequality. While GDP grows, wealth is concentrated among elites, and most Indians struggle with poverty, hunger, and joblessness. True growth must prioritize dignity, equity, and justice—not just impressive numbers and global rankings. Read here

- Indian Economy is Moving “Ahead,” Leaving Poor Behind! India’s poverty statistics may look optimistic, but millions still can’t afford two meals a day. Rising joblessness, slum demolitions, and farmer suicides reveal a darker truth: economic growth is bypassing the poor. Progress without inclusion is just a mirage. Read here

****

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.