CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 18-Aug-23 | 11-Aug-23 | Change |

| Nifty 50 | 19,310 | 19,428 | -0.61% |

| Nifty 500 | 16,758 | 16,860 | -0.61% |

| Nifty Midcap 50 | 10,824 | 10,822 | 0.02% |

| Nifty Smallcap 100 | 11,683 | 11,748 | -0.55% |

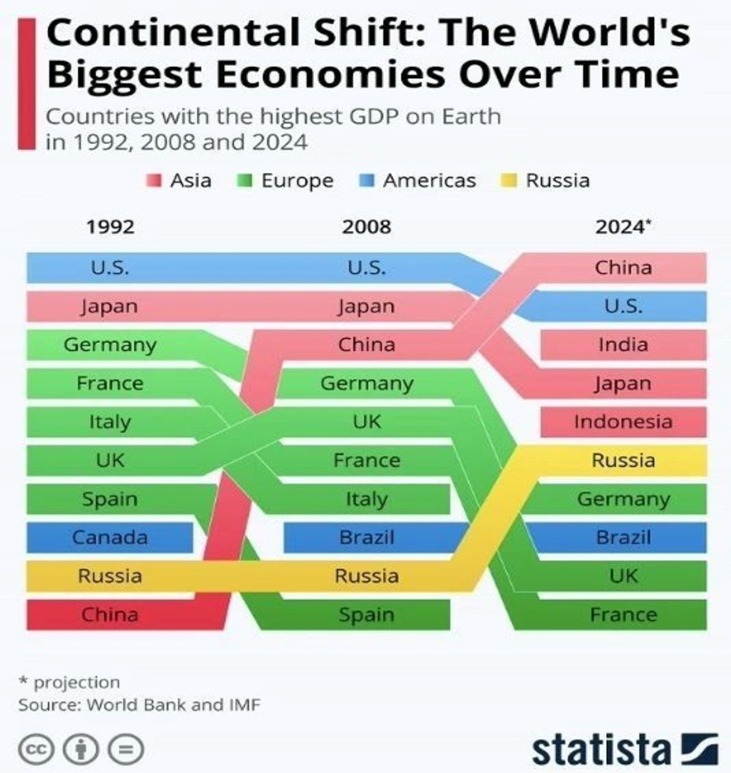

Chart Ki Baat

Gyaan Ki Baat

Solution Oriented Mutual Funds are close-ended funds designed to take into consideration future specific goals based on the investor’s flexibility and risk appetite. These funds were created to help investors plan for their major future goals such as child education, marriage, retirement, etc. at an early stage. These funds have a lock-in period of 5 years, which helps the fund ride out any short-term fluctuations in the market.

SEBI has specified two types of solution-oriented funds: Retirement funds and Children’s funds. The portfolio of these funds is customized as per the investor’s expected return to fund a certain future goal, their risk capacity during the term till the time they reach the goal period, and so on.

For example, some Retirement portfolios are designed considering the age of the investor – Investors with ages up to 30 years – have an aggressive portfolio allocation with 80-100% equity allocation. Whereas for investors above 50 years of age, the portfolio allocation is mainly conservative with high debt allocation.

Here’s the list of curated readings for you this week:

Personal Finance

- Bullish on India: Average income of middle-class Indians triples from Rs 4.4 lakh in FY13 to Rs 13 lakh in FY22. Read here.

- Tomato heat sets the thali boiling – The cost of a thali rose sequentially for the third month in a row in July, and also inched up on-year for the first time this fiscal, mainly due to soaring tomato prices. Read here.

- Paychecks and not portfolios – What’s the most important thing when it comes to building wealth? Is it what you invest in? Is it when you start? How about your mindset? Read here

- RBI launches unclaimed deposit platforms- The Reserve Bank of India (RBI) has launched a centralised web portal UDGAM (Unclaimed Deposits – Gateway to Access information), which simplifies people’s search for unclaimed cash deposit Read here

- How is India taking UPI globally – The move to accept payments in Singapore and other countries like Bhutan and Nepal is significant not only due to their economic links with India but also on account of the fact that UPI is being increasingly seen as a peer-to-global payment network. Read here.

- The Democratization of Opportunity in India’s Boardrooms– For the first time in India’s history, a majority of the promoters and executive directors of Nifty50 companies are NEITHER foreign educated NOR educated at the elite IITs & IIMs. Instead, majority of the people running Nifty50 companies now have ‘normal’ Indian degrees. Read here

- Legacy Firms In Diversification Drive – Most bets are in new-age businesses or sectors that are getting organised— for instance, semiconductor and solar module manufacturing are new while jewellery and lending are becoming more organised. Read here.

- Fitch Says Indian Banks On A Strong Growth Trajectory, Risks Receding – Capital ratio, earnings buffer, operating profit for Indian banks have improved significantly, says the rating agency. Read here

- Fuel cost is such a big part more than everything else put together- The ex-showroom price for a car only constitutes 20% of the vehicle lifecycle cost. See here

Economy

- India approves $7 bln plan for electric buses in nearly 170 cities – India on Wednesday approved plans for a nearly 580 billion rupee ($7 billion) scheme to deploy 10,000 electric buses in 169 cities over a decade, along with charging and associated infrastructure facilities. Read here.

- America is Increasingly Exceptional, in the Wrong Way – The United States is now virtually alone on a path toward higher spending, deeper deficits and debt Read here.

- India’s Future: The Quest for High and Stable Growth – The macro challenge for India in the upcoming decade is to turn traditionally uneven growth into a high and stable trend. Given structural differences with East Asian economies, India will need to follow its own unique path Read here.

****

Check out CAGRwealth smallcase portfolios here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.