CAGR Insights is a weekly newsletter full of insights from around the world of the web.

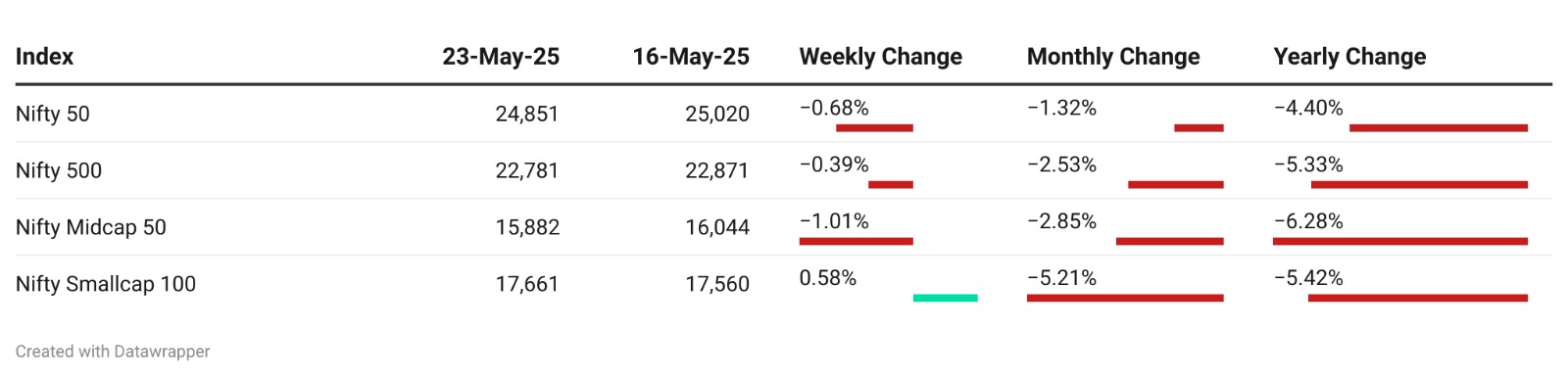

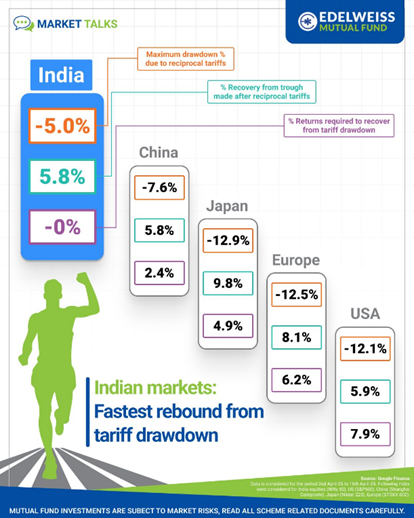

Chart Ki Baat

Gyaan Ki Baat

Why Circuit Breakers Matter to You as an Investor

Ever seen the stock market go into a freefall—or a sudden rally—and wonder why trading suddenly stops? That’s a circuit breaker in action. Much like a fuse that protects your home’s wiring during overloads, stock market circuit breakers pause trading when indices or stocks move beyond set limits.

Why? To cool down market panic, allow time for rational decision-making, and prevent knee-jerk reactions from spreading chaos.

Introduced after the 1987 crash, these halts now form a crucial layer of investor protection in markets worldwide, including India. But they’re not perfect—they can trigger more panic (the “magnet effect”) or delay true price discovery.

Still, understanding them helps you stay grounded. So, the next time trading halts, don’t panic—take it as a reminder to stay calm, assess your portfolio, and think long term.

Markets recover. Rationality always wins in the end.

Personal Finance

- 5 timeless money lessons from India’s Panchatantra Stories: What if your next money lesson came from a monkey, a prince, or a humble tortoise? Ancient Indian stories are not just about morals — they are treasure troves of timeless financial wisdom. From saving smart to avoiding greed, here’s how age-old tales can guide your money moves today. Read here

- Financial literacy for children: How small initiatives can help them grow into responsible adults: The RBI has revised guidelines allowing minors over 10 to independently operate savings accounts, promoting financial literacy. This initiative aims to equip young individuals with essential skills for managing money and accessing credit responsibly. Read here

- You Can’t Put a Price on Mental Freedom: Active investing doesn’t just risk your money—it hijacks your mind. You check stocks, chase performance, and tie your ego to every tick. For what? The real return isn’t financial—it’s freedom. Reclaim your time, your focus, your life. That’s priceless. Read here

Investing

- Helping the Gen Z invest: With Gen Z stepping into the workforce and gaining financial independence, their investment choices are reshaping the market. Companies are paying close attention. So, what are these new-age investors looking for? And why are SIPs and ELSS smart starting points on their wealth journey? Let’s break it down. Read here

- Are too many index funds a bad investment strategy? More index funds ≠ more diversification. Many track the same stocks, leading to repetition, not variety. True diversification comes from choosing funds with distinct market exposures. Always check overlap, segment focus, and risk-return profile before adding another index fund. Read here

Economy & Sector

- Trump’s tax on remittances won’t have big impact on Indian economy: The proposed US 5% tax on remittances is unlikely to significantly impact the Indian economy, though it may strain the diaspora and weaken the Rupee slightly. The actual effect depends on the tax’s fine print and potential offsets, with possible adjustments in remittance behaviour and fintech innovations to mitigate costs. Read here

- GDP ≠ Development: Analyst points to 12x income gap as India overtakes Japan: India is now the world’s third-largest economy, overtaking Japan—but GDP isn’t everything. With per capita income 12x lower than Japan’s, India’s size masks deep developmental gaps in infrastructure, innovation, and quality of life. Scale ≠ prosperity. Read here

- Indian Economy Exhibiting Resilience Despite Uncertainties: RBI India’s economy shows resilience amid global trade tensions, says RBI. Strong industrial momentum, easing inflation, robust agriculture forecasts, and stable macro fundamentals make India a standout for investors—especially as global markets face uncertainty and commodity volatility looms. Read here

****

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.