CAGR Insights is a weekly newsletter full of insights from around the world of the web.

Chart Ki Baat

Source: Mike Zaccardi on X

Gyaan Ki Baat

The Power of Missing Out

In investing, we’re often told to “never miss an opportunity.” Yet Warren Buffett himself admits that his biggest mistakes weren’t bad investments, but the ones he didn’t make—opportunities he let pass, sometimes worth billions. At first glance, this might sound alarming. But it’s deeply reassuring.

Why? Because it shows us that even the world’s greatest investor doesn’t (and can’t) catch every wave. Buffett and Charlie Munger famously ignored technology stocks for decades, passing on Google and waiting until Apple became less “tech” and more a consumer brand. Many see this as a failure. In truth, it was wisdom. For every Apple or Google, there were dozens of “next big things” that ended in disaster—Pets.com, WeWork, or Quibi. By staying within their circle of competence, Buffett and Munger avoided the far more costly mistakes of commission.

This is where the real lesson lies. Missing opportunities may sting in the short term but chasing investments you don’t understand can destroy wealth permanently. As Munger put it, “I try to avoid being stupid rather than trying to be very intelligent.”

For everyday investors, this is liberating. You don’t need to invest in every hot trend. You don’t need perfect foresight. What you need is discipline, patience, and the humility to say no when something lies outside your understanding.

Remember: the road to long-term wealth isn’t paved by catching every opportunity—it’s built by avoiding costly mistakes and staying within your circle of competence. That’s the real power of missing out.

Personal Finance

- How to fix errors in your credit report and improve your credit score? Here are 6 key ways: Fixing errors in your credit report is essential for improving your credit score, ensuring accurate financial records, enhancing loan approval chances, and unlocking better credit opportunities with simple corrective steps. Read here

- How wealthy investors use ETFs to skirt capital gains taxes. The strategy is ‘like magic,’ advisor says: Wealthy investors avoid capital gains taxes by using a 351 conversion to transfer profitable assets to an exchange-traded fund. The strategy seeds ETFs before launch, and the original investor defers capital gains until selling their shares. Read here

- ‘How a car in India keeps you broke’: Middle class mistaking liabilities for assets: As economic pressures tighten, Sujith’s financial cautioning is striking a chord with a middle class caught between past optimism and present strain. Read here

Investing

- Optimizing Ourselves to Death: Optimization culture has gone from helpful to harmful—turning health, time, and productivity into obsessions. But what if chasing perfection is ruining life itself? Read here

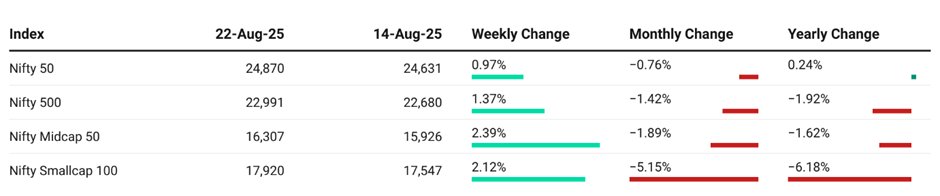

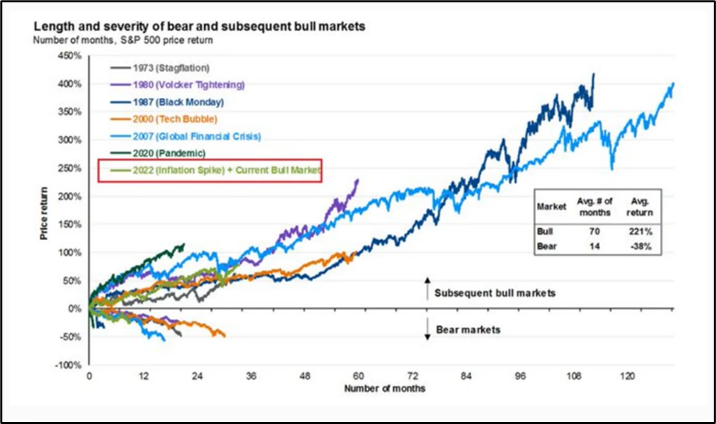

- Why Every Bear Market Creates the Next Big Bull Run: History shows bear markets are short and painful, but bull runs last longer and deliver outsized gains. With current consolidation in India, patience matters—today’s declines could be the foundation for tomorrow’s powerful rally. Read here

- Changing Indices and Your Investments: Ever wondered why big companies that once ruled the markets are nowhere to be seen today? From Hindustan Motors to Satyam, history shows indices keep evolving—dropping the weak, adding the strong. That’s why investing in indices is like riding with tomorrow’s winners. Read here

Economy & Sector

- India’s private sector posts record growth in August: HSBC flash survey: The HSBC flash India Composite Output Index, which tracks month-to-month changes in combined output across manufacturing and services, jumped to 65.2 in August from 61.1 in July. Read here

- U.S. tariff impact: India sees Asia’s biggest earnings downgrades: Earnings growth for Indian companies has been in single-digit percentages for five consecutive quarters, below the 15%–25% growth seen between 2020–21 and 2023–24. Read here

- Centre removes cotton import duty till Sept 30 to aid textile sector: The Centre has waived the 11 per cent duty on cotton imports till September 30, providing relief to the textile industry facing higher US tariffs and intense global competition. Read here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.