CAGR Insights is a weekly newsletter full of insights from around the world of the web.

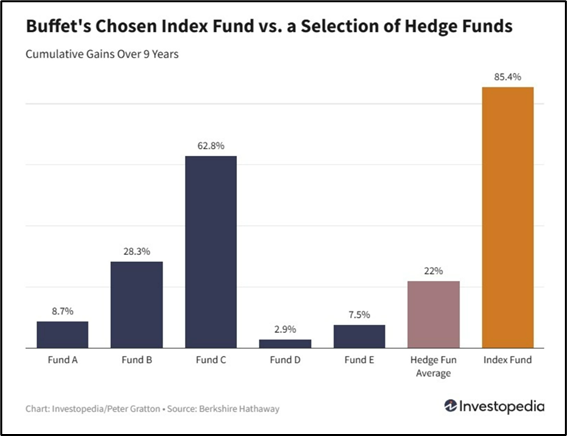

Chart Ki Baat

Gyaan Ki Baat

The One Conversation You Can’t Afford to Delay

Growing up, money was a taboo topic in most Indian households—especially between parents and children. But today, the silence is costing families more than they realise.

A recent report shows that nearly 70% of India’s elderly are financially dependent—either on their children or by working well beyond retirement age. And with inflation eating into savings and healthcare costs on the rise, the emotional and financial burden on the next generation is only getting heavier.

That’s why it’s crucial to have the “money talk” with your parents now—not during a crisis.

This isn’t about control; it’s about care. Start small. Ask them if they feel confident managing their expenses in the years ahead. Discuss their health coverage. Understand if their retirement income can sustain them. These conversations can reveal silent stress—and help you plan together for a more secure future.

If your parents are still 5–10 years away from retirement, help them balance equity and debt wisely based on their goals and risk appetite. If they’re already retired, explore options like Senior Citizen Savings Schemes, debt funds, or annuities that can offer regular, safe income.

Remember, the greatest gift you can give your parents isn’t money—it’s peace of mind. And that starts with one open, honest conversation.

Let’s not wait for hospital bills to bring us together. Let’s plan while there’s still time.

Personal Finance

- Income Tax: What happens if you don’t file ITR for multiple years? Legal and financial consequences explained: Not filing income tax returns for multiple years leads to heavy penalties, interest, prosecution risk, and loss of financial benefits, making timely income tax filing essential for long-term compliance. Read here

- Wealth management in times of layoffs – 7 money tips to keep you money stress free: Layoffs are hitting harder and faster than ever—are you financially prepared? From emergency funds to smart investing, here are 7 money moves you must make to stay secure when uncertainty strikes. Read here

- Are you very frugal when it comes to spending? These signs could mean you’re over-saving but under-living your life: Chrometophobia is an extreme case of fear, anxiety and panic at the thought of spending money. A small fraction of people suffers from this irrational affliction. It’s not a very well-understood or diagnosed condition, but in some milder formats, it does exist around us. Some of us are able, but not willing to spend. Read here

Investing

- It’s the Housing, Stupid: Meme stocks are booming, cash is piling into money markets, and millionaires are renting—what’s going on? It’s not a market frenzy—it’s a housing crisis. High prices and rates have broken the system. Curious how? Read here

- How Market Cap Categories Have Evolved in India: India’s stock market has evolved massively in 20 years—today’s small caps are bigger than yesterday’s large caps! Learn how market cap definitions have shifted, what it means for investors, and why categorization may limit opportunity. Read here

- The Psychology and The Math Behind Deep Drawdowns: A small loss is a scratch; a big one can bury your portfolio. The deeper the fall, the harder the climb. Know when to cut your losses—because recovery isn’t just math, it’s mindset too. Read here

Economy & Sector

- From seafood to auto: How will Trump’s 50% tariff impact different sectors: Trump’s 50% tariff hike on Indian exports threatens jobs and cripples’ key sectors like seafood, textiles, and gems. With losses mounting and firms eyeing relocation, all eyes are on urgent India-US talks. What’s next? Read here

- India’s services sector rises to 11-month high in July: India’s services sector just hit an 11-month high, driven by booming global demand—despite a hiring slowdown and rising inflation. Finance is thriving, real estate is lagging, and RBI’s next move hangs in the balance. Curious why? Read here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.