CAGR Insights is a weekly newsletter full of insights from around the world of the web.

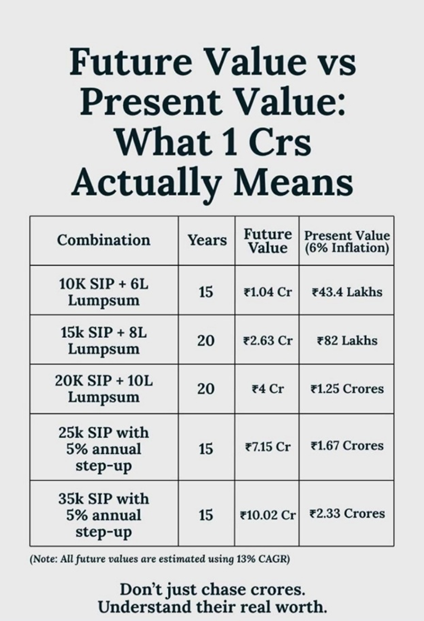

Chart Ki Baat

Gyaan Ki Baat

Want to Be a Better Investor? Study Failures, Not Just Successes

We’re all drawn to success stories—the investor who bought Amazon early, the fund that doubled in a year, the stock that turned rags into riches. But here’s a simple truth: success can be misleading. What often gets ignored are the countless failures that didn’t make the headlines.

Mohnish Pabrai, a well-known value investor, credits much of his investment approach to “cloning” the greats—Warren Buffett, Charlie Munger—not just by following their successes, but by deeply understanding their mistakes. Why? Because mistakes teach far more than wins ever will.

Success often carries the risk of survivorship bias—we see only what worked, not the thousands of similar bets that failed. On the other hand, mistakes follow patterns. Panic selling, chasing hot stocks, falling for “this time it’s different”—these behaviours have repeatedly destroyed wealth across generations and geographies.

Studying failures develops what psychologists call defensive pessimism—not negativity, but a realistic mindset that anticipates risks and builds resilience. The most successful investors aren’t flawless—they’re just better at avoiding big blunders. They don’t try to predict the future; they protect against predictable errors.

So, before you jump on the next big trend, pause and ask: What went wrong for others in similar situations? You’ll gain an edge—not by finding the perfect investment, but by avoiding the obvious traps.

💡 As Buffett says: Rule No. 1 — Don’t lose money. Rule No. 2 — Don’t forget Rule No. 1. Studying mistakes is the best way to follow both.

Personal Finance

- NRI wins capital gains tax case in Delhi High Court regarding sale of Rs 2 crore property despite Rs 46 lakh tax demand notice: An NRI faced tax issues after a property sale in Pune for Rs 2 crore. The buyer used the wrong TDS form (26QB), causing problems. The Income Tax Department issued a tax demand notice of Rs 46 lakh. The Delhi High Court intervened, directing the department to correct the TDS records. The court ordered a tax refund computation for the NRI. To know more Read here

- How to switch health insurance without losing benefits: Insurance regulator allows you to switch health insurers without losing benefits like waiting period credits and bonuses. Here’s how to port your health policy for better features and fewer claim rejections. Read here

- How to plan for regular holidays abroad: Want to travel every two years without guilt or financial stress? Discover the smart system that helps you fund 20 epic holidays—without compromising your big goals. The secrets in the step-up strategy—click to see how it works! Read here

- The Separate + Joint Method: How My Spouse and I Manage Our Money: Pooling everything? Keeping it separate? We found a smarter third way. It’s simple, fair, and gives us both freedom and shared purpose. Six months in—and we’re closer than ever. Curious how it works? Click to read our full story. Read here

Investing

- For Diversification from Stocks, Cash Has Made a Good Case for Itself: New data from Morningstar shows cash—not bonds—was the real hero during recent market shocks. With correlations shifting and traditional diversification tools faltering, it’s time to rethink your safety net. Click to discover which assets protect your portfolio—and which ones are secretly riding the same roller coaster as stocks. Read here

- 5 reasons long-term investing beats day trading: Dreaming of quitting your job to day trade? Here’s why that’s a fast track to stress and losses. Long-term investing builds real wealth—with less risk, more sleep, and beach days instead of burnout. Want to know why traders rarely win? Read here

Economy & Sector

- How formal staffing can drive India’s job quality and economic growth: India’s job crisis isn’t about quantity—it’s about quality. As informal work dominates, the formal staffing industry emerges as a game-changer. By bridging skill gaps, formalising employment, and supporting MSMEs, it can drive productivity, stability, and inclusive growth. Can staffing firms reshape India’s workforce future? Read here

- India’s share in global exports touch 3% on booming services: India’s share in global exports rose to 3% in 2023 from 2.2% in 2010, growing at 6.3% annually—the fastest among major economies, says UNCTAD. Driven by booming services, resilient trade policies, and strong manufacturing, India’s exports reached $825 billion in 2024-25. Read here

- How Geopolitical Headwinds Are Casting a Shadow Over India’s Economy: India’s economy faces rising external risks—from crude oil shocks to rare earth shortages and trade tensions. Experts warn of policy limitations, even as India eyes global manufacturing shifts in its favour. Read here

****

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.