Shrivastava uncle is 72 and his wife, Manjula aunty is 68. They are my next door neighbours. Extremely sweet and affectionate, they love to talk. They have three kids – all married and employed. Uncle himself was a tax consultant till a few years back. As he grew older, his ability to work 8 hours a day and scout for new clients declined. His existing client base who was also largely retired did not need his services anymore. Aunty is a quintessential homemaker, devoted to the family ever since she was married to uncle. To me, they are a classic representation of the vast majority of our retired parental generation in India.

Last Sunday we met over tea and aunty made some delicious pakodas. As I noted down her recipe, uncle advised me to go slow on fried food. Two reasons – rising oil prices and rising healthcare costs. He said, the joy of fried food is “not worth it”.

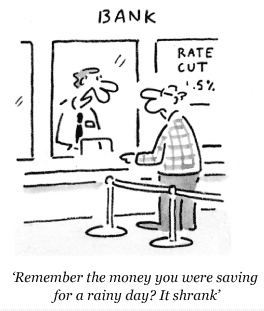

Uncle and aunty had always lived a middle class lifestyle. Moderate income with significant monetary commitments towards their children. They wanted their children to get the best of education. But they had not fathomed the kind of money they would need to shell out just for schooling and tuitions, let apart the cost of higher education. So every child ended up taking a loan for pursuing their masters / post – graduation. They bought a home early in life and the EMIs continued till after their second child got married. And for all of his working 35 years, uncle’s sole intention was to save enough for getting his three kids married off in style. But with rising costs of the pomp and show of marriage, his fixed deposits were not enough. So he ended up withdrawing his PF and PPF – because it is so much more fulfilling to walk your chin up in the society than leading a comfortable retired life. So now, they have a handful of savings, minimal passive income and no monthly inflows. They definitely do not live the way they would have liked to.

I sometimes asked them why their children could not send him a monthly cheque so that they did not have to cut down on their lifestyle. They never really answered but I knew that like most parents of their generation, they always wanted to be a giver to their children. It was a matter of self – esteem to not depend on the ones you have raised. Sometimes, uncle used to say that his children need to save for their own retirement, not his. I have met his children – they are very nice people. They visit their parents often and want to help them. But they do not help because they cannot see their father feel dejected at the reality of having to depend on children.

This predicament is not unusual in our current social fabric. Some children don’t care about their parents. For those that do, the parents don’t want to be termed as dependents. It is an eternal sense of insecurity that lingers once the monthly inflow stops. The eventualities are something no one really plans for. Cost of living rises in ways we don’t visualize well in advance. We need to outsource daily chores more than we have ever had to and healthcare constitutes a big chunk of monthly expenses. Since there is so much more free time in a day, the desire to have a social life also increases. The costs of upkeep of that social life varies from household to household.

In India, we do focus on saving for our child’s marriage and may be also education. But retirement was and still is missing from the list of priority financial objectives. To our generation who has just started out on their long careers, retirement seems just too far off. And we hate to look that ahead in time. Some of my friends jokingly retort – who knows if we will be living till then. Well, the mortality rates have definitely gone up.

Some people believe that purchasing a house is all that they need for retirement. But what about the daily cash-flows? The salaries you need to pay to the domestic helpers, the driver and the newspaper man. The rising expenses on milk and flour. The medicines. The gifts that you want to give to your grand- children. We hardly plan for a life which is perhaps going to be so different from what we are currently living. And by the time we do, it is usually too late.

Let us therefore awaken and become more responsible, starting with ourselves. Next time, before you start planning for your child’s graduation expenditure, do set aside a sum for your happy retirement. It is alarmingly more important than you think it is.

About the author:

Shruti is a financial planning enthusiast and spends substantial amount of her free time in helping out her friends and relatives sorting out their finances. Currently working with Mahindra & Mahindra, she is one of our esteemed guest writers. She is an MBA from MDI Gurgaon and a CFA (CFA Institute, USA).

About CAGRfunds:

We are a bunch of financial experts who help people manage and grow their wealth. We focus on making our clients financially independent by educating them and guiding them throughout their financial journey. If you think you need help with your money, reach out to us on +91 97693 56440.

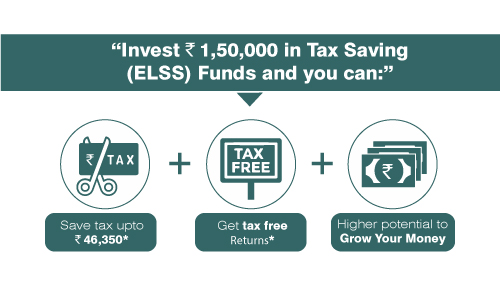

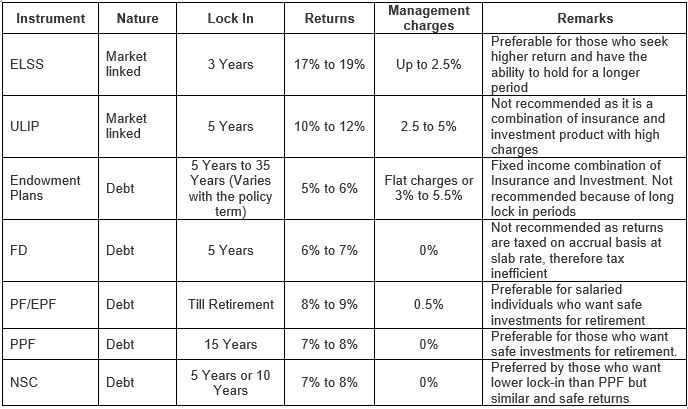

ELSS will therefore be appealing to an investor who has a higher risk appetite as ELSS funds have the potential to outperform and generate better returns than FDs, NSCs, and PPF/EPF.

ELSS will therefore be appealing to an investor who has a higher risk appetite as ELSS funds have the potential to outperform and generate better returns than FDs, NSCs, and PPF/EPF.