CAGR Insights is a weekly newsletter full of insights from around the world of the web.

Chart Ki Baat

RBI’s Consumer Confidence Survey

Gyaan Ki Baat

Understanding Fed’s Dot Plot

The dot plot is an essential tool used by the Federal Reserve to communicate its outlook on future interest rates. Here’s what you need to know:

What is the Dot Plot?

- Definition: The dot plot is a graphical representation of the Federal Open Market Committee (FOMC) members’ projections for the federal funds rate over the next few years and in the longer term.

- Visualization: Each dot represents an individual member’s forecast, providing a visual summary of their expectations.

Importance of the Dot Plot

- Quarterly Updates: The dot plot is updated four times a year, reflecting real-time assessments of economic conditions.

- Market Insight: Investors and analysts closely monitor the dot plot as it serves as a forward guidance tool, influencing market expectations regarding monetary policy.

Recent Trends

In the latest update, the median projection indicated only two interest rate cuts by 2025, suggesting a more cautious approach compared to previous forecasts.

This shift highlights how economic factors, such as inflation and labor market conditions, impact Fed decisions.

Personal Finance

- Budget 2025: Govt may cut income tax rates to lift consumption, says report: India’s budget buzz is building, and a potential income tax cut is on the horizon! With the economy slowing and the middle class feeling the pinch, there’s talk of giving taxpayers a little extra relief. Read here

- Confused as how GST hike on used car will work? Here’s how a higher GST of 18% will impact individuals and businesses: The GST Council’s latest move: an 18% tax on used car sales for specific vehicles, including EVs and larger engines! While most businesses can’t claim input tax credit, car showrooms and transporters get a pass. To learn who’s paying and how. Read here

- Why your credit score is not improving despite timely bill payments: A stagnant credit score despite timely bill payments can be due to high credit utilization, inaccuracies in credit reports, limited credit mix, too many credit applications, or past negative records. To improve the score, manage credit usage, maintain timely payments, and monitor credit reports for errors. Read here

Investing

- What valuations of Indian banks are indicating? Indian private banks are turning heads! Despite recent underperformance, they’re trading at compelling valuations with strong fundamentals backing them. With profitability at decade highs and exciting growth potential, is this the moment for private banks to reclaim their spotlight? The story is just getting started Read here

- A Litany of “I Told You So”: The 2020–2024 Indian market flipped the investing playbook, smashing old rules as sky-high valuations defied correction calls. Everyone’s yelling “I told you so,” but timing was a wild card. The real lesson? Read here

- Why is one Nasdaq FOF earning 60 per cent more than the other? Imagine this: two Nasdaq-100 mutual funds in your portfolio, both tracking the same index, both aiming for identical goals. Yet, their one-year returns couldn’t be more different—35% versus 56%! What’s happening behind the scenes? A fascinating interplay of demand, regulations, and pricing quirks is rewriting the script. Curious? Read here

Economy & Sectors

- India power equipment sector – Recouping the lost decade: India’s power sector is charging ahead! With rising demand from manufacturing, renewable energy, and data centres, investments are set to skyrocket. By FY32, capacity will double, unlocking huge opportunities for power equipment manufacturers. Read here

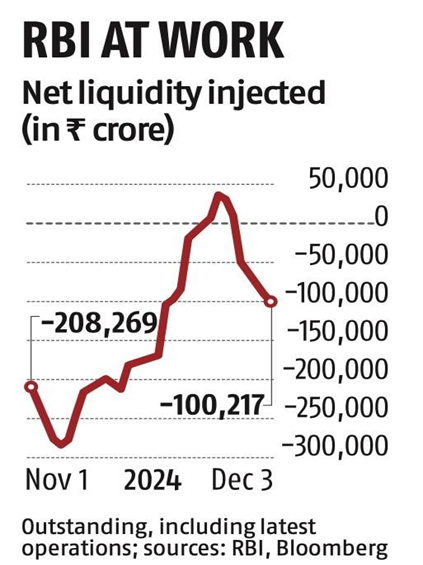

- India Sees Economic Growth at 6.5% for the Year Through March: India’s economy is forecast to grow at 6.5% in FY 2024-25, down from 8.2% last year. Slower growth, global trade risks, and currency weakness impact the outlook, with economists expecting a possible RBI rate cut in February. Read here

- Weak rupee to jack up key import bills: The weakening of the Indian rupee could increase the import bill by $15 billion, with significant impacts on commodities like edible oils, pulses, and fertilizers. Electronics, particularly smartphones, may become costlier, while the impact on energy imports is offset by falling oil prices. Read here

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.