CAGR Insights is a weekly newsletter full of insights from around the world of the web.

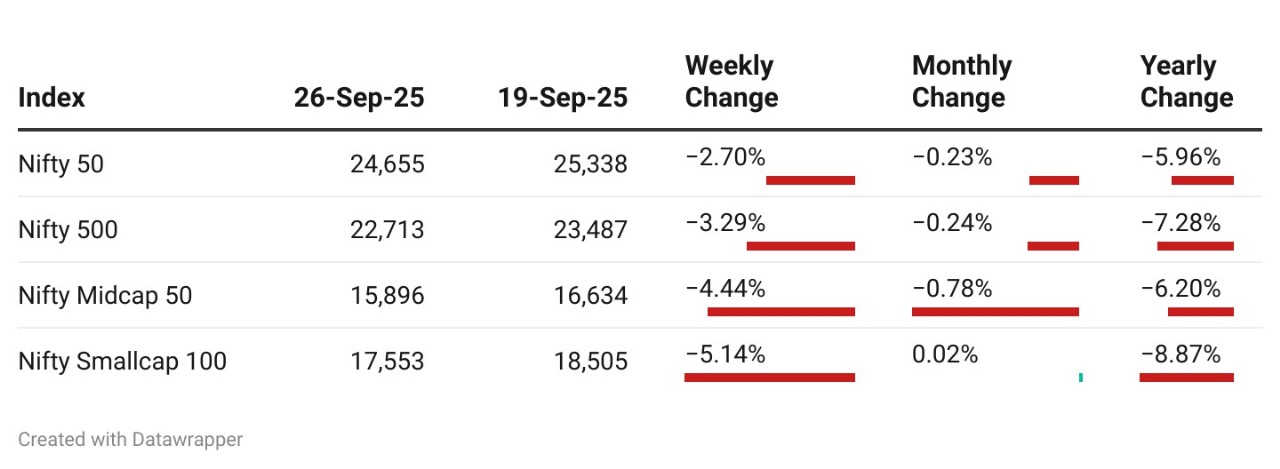

Chart Ki Baat

Gyaan Ki Baat

Planning in an Unpredictable World

Ronald Reagan once joked about Soviet life, where a man had to wait 10 years to collect a car. When asked whether he should come in the morning or afternoon, he replied, “The plumber is scheduled that morning.” The absurdity highlights a harsh truth: life under unpredictable systems isn’t about waiting—it’s about the impossibility of planning rationally.

Today, we see similar challenges globally. Take the recent H-1B visa fee hike in the U.S.—a 2,000% increase overnight. Indian professionals abroad suddenly face life-altering decisions: move now or later, manage careers, children’s education, and family health—all under uncertainty. Businesses are no different. Erratic trade policies and shifting tariffs make long-term investment decisions nearly impossible. A company cannot plan factory builds or supplier contracts when trade rules can flip in months.

The bigger cost isn’t the policy itself—it’s the behavioural change it triggers. Companies become ultra-conservative, delay expansion, diversify excessively, and hoard cash. Families rethink careers, travel, and education. Even when policies stabilize, the caution lingers, slowing growth and efficiency.

For investors and entrepreneurs, the lesson is clear: unpredictability is as much an economic drag as any tax or tariff. The winners will be those who adapt quickly, stay flexible, and plan for multiple scenarios. Like the man waiting ten years for his car, success comes not from controlling the world, but from learning to navigate it intelligently.

In an unpredictable world, the smartest move isn’t rushing blindly—it’s planning wisely, adapting continuously, and staying prepared for whatever comes next.

Personal Finance

- Starting young with insurance: How much cover do you really need? Should you buy life cover in your 20s, and can freelancers get health insurance that covers therapy? An expert explains how to secure affordable protection without overcommitting. Read here

- RBI issues directions for digital payment transaction authentication mechanism: The Reserve Bank of India (RBI) has issued new guidelines for digital payment authentication, effective April 1, 2026, mandating two-factor authentication for all transactions. These guidelines emphasize dynamic authentication factors, risk-based checks, and validation of cross-border transactions. Issuers must implement mechanisms for handling cross-border CNP transactions by October 1, 2026, and register their BINs with card networks. Read here

- Credit cards vs BNPL in India: Which is better for you in 2025? In 2025, smart spending is all about choosing between Credit Cards and BNPL. Cards give rewards and global perks, while BNPL offers quick, interest-free instalments. Discover which one fits your lifestyle—and how combining both could boost your finances! Read here

Investing

- Why the 5% Rule is the New 4% Rule: Think the 4% Rule limits your retirement? Bill Bengen’s new book reveals you could safely spend more—maybe even retire sooner—and finally enjoy your golden years worry-free! Read here

- China’s Rising Yuan: How De-Dollarization Is Reshaping Global Trade: In just 15 years, China has shifted nearly half of its cross-border trade to the yuan. De-dollarization is accelerating, global trade is evolving, and the world’s financial order may never look the same. Read here

- The Rise and Fall of Options Trading by Indian Retail Investors: Retail options trading in India surged eight-fold from 50M to 375M contracts in just a few years—but volumes have now tumbled back to 80M. Market frenzies are temporary; skill, discipline, and caution remain key. Read here

Economy & Sector

- Consumption conundrum: On the Indian economy’s predicament: With private investment sluggish and exports under pressure, the government is re-prioritizing household consumption to drive growth. GST reforms and income-tax cuts help but boosting spending also requires higher wages and targeted fiscal support. Consumption is now the engine India must rely on. Read here

- India, US make ‘progress’ for joint trade-oil deal as talks move forward: Amid U.S. tariffs pressuring India over Russian oil purchases, Secretary of State Marco Rubio says progress was made in recent trade discussions. Negotiations continue, covering tariffs, skilled worker access, and market reforms. Read here

- India pegs its logistics cost lower than China in terms of percentage of GDP: India’s logistics cost stands at 7.97% of GDP, lower than China, driven by rail efficiency and reforms. Initiatives like freight corridors and Gati Shakti are gradually reducing costs and improving multimodal connectivity. Read here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.