A few days back, I met an old school friend Rajeev on my flight from Mumbai to New Delhi. We started reminiscing about our old school days and the time just flew by. Rajeev has done well in his career and is working as a Management Consultant with a reputed consulting firm.

Somehow, the discussion shifted to financial planning and Rajeev told me, that he is quite happy seeing his investment grow at 8%. This got me interested, so I further enquired and discovered that he has invested his savings in long tenor bank fixed deposits. I was surprised and explained to him that he is only looking at nominal returns and there is more to returns than what meets the eye.

This got me thinking, do we as investors really know the actual returns of our investment? No, it’s not because we don’t read the numbers, but because we don’t understand how to find the net returns of our investment. Most people only care about the raw returns on their investment and unfortunately this is not the return to actually care about.

The two most important factors which impact our investment are taxation and inflation. While, the impact of taxation is still comparatively easy to understand, as on paper it leads to reduction in earning, the impact of inflation is more insidious.

With regards to taxation, every investor should look at the “after tax” return of his investment, but we will discuss this at some other time. Today let’s try to delve into the impact of inflation on our investment return.

Let’s get back to Rajeev and his investment in bank FD earning 8% return. Is he actually earning 8%? No, he is not. This is his “before tax” and “nominal return”. For the time being, let’s ignore the impact of taxation and discuss further on “nominal return”.

As investors, we have to factor in the bite of inflation and look at the “real return”. In the above case, if the current inflation is 7%, the real return for the investment this year is only 1%. Why is that? Inflation represents loss in purchasing power. Simply put, 10 years back you can buy much more with 100 rupees in your account, than you can buy today. Inflation can affect the risk/return profile of any asset, including cash.

Investments offering you miniscule or negative real returns will actually lead to loss in purchasing power and are actually making you poorer over time. For example, savings account seems to provide a sense of security and guarantees “nominal return” of 4%; it actually is making you poorer by 3% (considering inflation is 7%). Same is the case with bank fixed deposits; it mostly gives you either negative real return or at maximum gives miniscule real return.

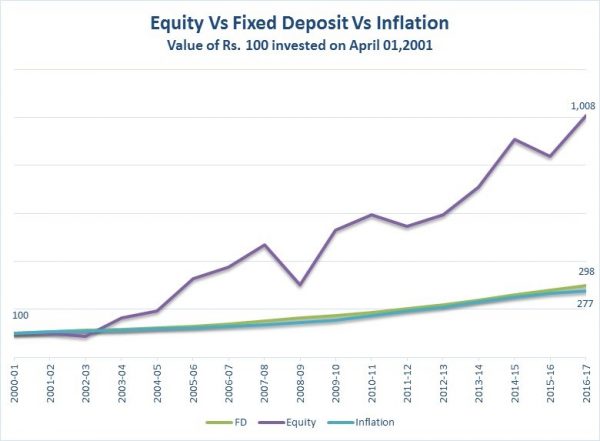

Historically as per the chart above, investment in equities has offered higher real returns compared to fixed deposits. Hence, it is seen as a good hedge against inflation. Investments done in fixed deposit have barely been able to beat the inflation over the years, while the investments in equity have given handsome returns over long period of times.

If you find it difficult to choose the right companies for investing, you could opt to invest through mutual fund schemes, preferably through the Systematic Investment Plan (SIP) route.