What is this series about?

We have all heard a lot about the ace investor Warren Buffet. But how many of us have really read through his letters? So here we are, launching a learning series where our expert Mr. Kshitiz Jain summarizes the learning from each of his letters and connects it to what it means for us. So whether you invest in stocks or mutual funds, do takeaway some key learning for investing in general!

Also, participate in sharing the knowledge. So do Comment / Share / Like.

Berkshire Hathaway Shareholder letter – 1977

Characteristics of Good Management : Buffet letters gives us a lot of insight on this matter

- Buffet prefers to give his shareholders bad news first, followed by good news. There are various evidences throughout the letters. This is a hallmark of good management, while reading annual reports look for these characteristics.

- Good Management will readily accepts its mistake and instead of finding excuses looks to either cut losses or keep their shareholders well informed about their mistake and learning from it. Buffet accepts that Textile business has not been working well and explains in detail the reason why they are continuing with the business.

- Good management will give clear guidance and instead of being just overly optimistic, good management will manage shareholder expectations honestly.

- Managerial Discipline even in the wake of industry wide malpractices.

Investing gyaan: Buffet gives us a unique insight in his style of investing

- While investing in stocks evaluate as if you are buying ownership of the company and not just looking to earn short term gains.

- Buffet defines the type of business, one should invest in:

- One that we can understand,

- With favorable long-term prospects,

- Operated by honest and competent people

- Available at a very attractive price.

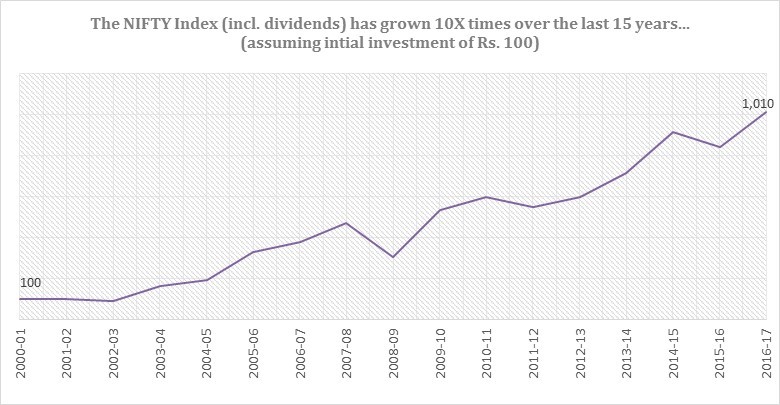

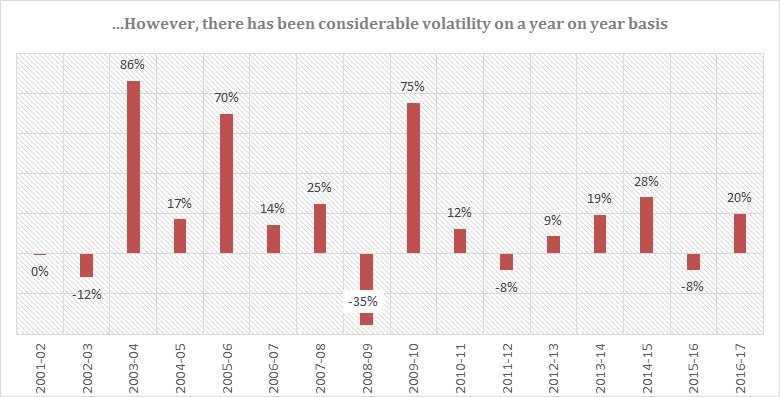

- Long term investment horizon and ignoring short term volatility – “Most of our large stock positions are going to be held for many years and the scorecard on our investment decisions will be provided by business results over that period and not by prices on any given day.”

- Invest in companies or industries where the industry scenario is favorable, this gives the company scope to make mistakes, learn and move on – “One of the lessons your management has learned – and, unfortunately, sometimes re-learned – is the importance of being in businesses where tailwinds prevail rather than headwinds.”

- Stock market gives you opportunities to buy outstanding businesses at discounts which will not be available, if you are looking to acquire entire companies – “Our experience has been that pro-rata portions of truly outstanding businesses sometimes sell in the securities markets at very large discounts from the prices they would command in negotiated transactions involving entire companies. Consequently, bargains in business ownership, which simply are not available directly through corporate acquisition, can be obtained indirectly through stock ownership. When prices are appropriate, we are willing to take very large positions in selected companies, not with any intention of taking control and not foreseeing sell-out or merger, but with the expectation that excellent business results by corporations will translate over the long term into correspondingly excellent market value and dividend results for owners, minority as well as majority.”

My two cents

Buffet helps us to answer two of the most important question that an investor needs to answer. I have tried to extend these learning further for mutual fund investors.

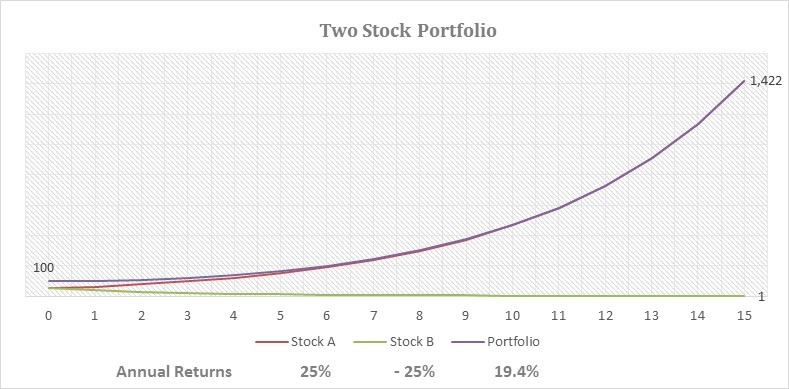

Where to invest?

Invest in good quality well managed businesses that you understand and are available at attractive prices. This is one of the most important learning that investors should always try to invest in quality business, even if they may not be the flavor of the month. A good quality well managed business that is currently out of favor is the best thing that can happen for an investor. Similarly, good quality mutual funds managed by fund managers with long term track records may under perform for short periods in between but will give higher returns in the long term.

How to identify good management?

Management that is honest, manages shareholders expectations with clear guidance, readily accepts mistakes and disciplined. Similarly, a mutual fund manager who has a disciplined approach to investing and does not waver from his investing style and fund mandate even in tough market situations would be someone to entrust your investments with.