CAGR Insights is a weekly newsletter full of insights from around the world of web.

| Index | 03-May-24 | 26-Apr-24 | Change |

| Nifty 50 | 22,457 | 22,453 | 0.02% |

| Nifty 500 | 20,948 | 20,859 | 0.43% |

| Nifty Midcap 50 | 14,190 | 14,083 | 0.76% |

| Nifty Smallcap 100 | 16,934 | 16,979 | -0.26% |

Chart Ki Baat

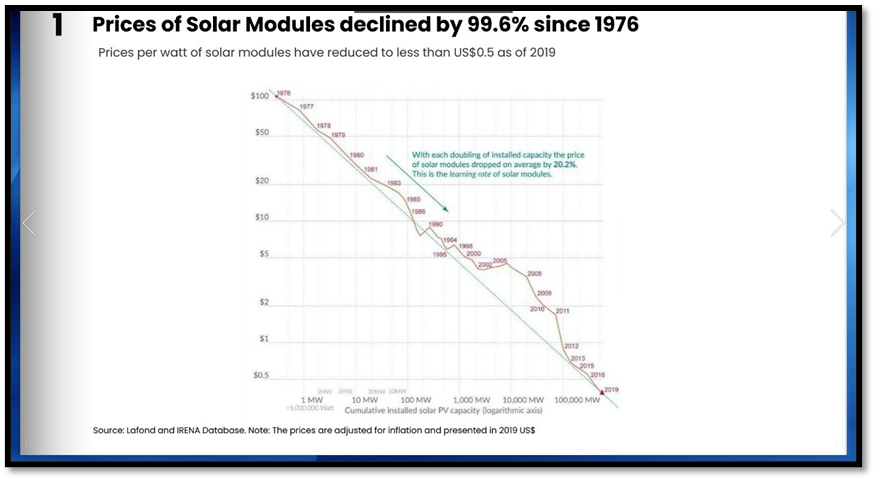

Source: Lafond and IRENA Database.

Here’s the list of curated readings for you this week:

Personal Finance

- Understanding the Psychology of “Bad” Financial Decisions: Insights from American Lotteries and Economic Realities – Delves into the psychology behind “bad” financial decisions, highlighting the complex motivations and circumstances that drive individuals, especially those in lower-income brackets, to engage in seemingly irrational behaviors like playing the lottery or investing in high-risk ventures. Read here

- Navigating Risk: Lessons from Golf and Investing – Contrasts the success of golfers Rahm and Scheffler, highlighting their different risk-taking approaches, and draws parallels to investor behavior, advocating for disciplined adherence to investment strategies amidst market volatility. Read here

- Shruti Agrawal’s journey as a CFA Charter Holder – Check out this video by CFA Institute: The Journey of Women in Finance featuring Shruti Agrawal, sharing her insights on a successful career in finance. Read here

- The High Cost of Tax Avoidance: A Billionaire’s Tax Dilemma – how ultra-rich individuals meticulously strategize to minimize taxes, highlighting the lengths they go to in avoiding NYC’s tax status threshold, questioning whether such actions truly reflect wealth or rather signify being controlled by money. Read here

Investing

- The Rise of Crypto Zombies: Billion-Dollar Blockchains with Few Users – proliferation of zombie blockchains, including Ripple’s XRP, Bitcoin Cash, Litecoin, and Ethereum Classic, which continue to trade at high valuations despite limited utility and user adoption, presenting challenges for investors and regulators alike. Read here

- Debt and Enduring Resilience: A Perspective on Financial Stability – The enduring success of ultra-durable businesses called “shinise” and highlights how their aversion to debt enables them to withstand centuries of calamities, offering a perspective on debt as a constraint on life’s volatility and the importance of maintaining options and flexibility. Read here

- Stoic Wisdom: Navigating Market Volatility and Investing with Serenity – Explores the tendency for investors to panic over geopolitical events, emphasizing the importance of maintaining a stoic mindset, avoiding macro tourism, and sticking to diversified, long-term investment strategies amidst market volatility. Read here

- Unlocking India’s Investment Potential: Shifting Paradigms for Economic Empowerment – How India’s traditional asset allocation has led to significant wealth loss, emphasizing the need for a shift towards equity and diversification to unleash greater growth and economic prosperity. Read here

Economy

- Navigating Valuation Multiples: Understanding Differences and Linking to Fundamentals –Counterpoint Global Insights explores the limitations of valuation multiples and their divergence due to shifts in investment trends and capital structures, highlighting the challenges in accurately reflecting company fundamentals. Read here

- India’s Thriving AI Ecosystem: Driving Innovation on the Global Stage – India’s AI sector is booming, marked by significant contributions to global AI research and GitHub projects, though challenges in data quality persist, with government initiatives and investments driving innovation and development. Read here

- SEBI’s Face Value Reduction Boosts Retail Participation in Bond Market – SEBI’s decision to reduce the face value of privately listed NCDs to Rs. 10,000 from Rs. 100,000 is hailed as a game-changer, opening doors for increased retail participation in the Indian debt market. Read here

****

CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1 year returns.

- CFF (launched in June 2022) – Ranked among Top 20 smallcase with medium volatility.

- CVM (launched in May 2022) – Ranked among Top 40 across the smallcase universe.

Do check it out here.

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.