Chart Ki Baat

Here’s the list of curated readings for you this week:

Personal Finance

- Guaranteed Stability of UPS vs. Flexibility of NPS for Government Employees – The Unified Pension Scheme (UPS) offers government employees a guaranteed pension, dearness relief, and a lump-sum benefit. It’s a more secure option compared to NPS, but with potentially lower returns. Ready to make an informed decision about your retirement? Read here

- How Social Media Platforms Cash In on Pig Butchering Scams – Are you tired of the relentless onslaught of online scams? The “pig butchering” scam is a particularly insidious scheme that targets unsuspecting individuals, often with devastating financial consequences. Want to know how to protect yourself and your loved ones from these ruthless scammers? Read here

- How a Friend’s $81 Shaped a Future President – Ben Crider’s loan to Lyndon B. Johnson was an investment in human capital with a significant ROI. While the initial amount was small, Johnson’s subsequent success generated immense economic and social value. This story highlights the power of investments in people and the potential for long-term returns. Read here

Investing

- WazirX’s Cybertheft Recovery Plan – Zettai Pte., WazirX’s parent company, is seeking a white knight for capital after a $235 million hack. Only 55% of stolen funds are expected to be returned. The restructuring process will take at least six months. To know if WazirX can recover from this massive blow Read here

- Tapping Into Underrated Market Opportunities – While popular sectors may seem attractive, undervalued segments like value stocks and private banks can offer significant returns. By investing against the grain, you can potentially outperform the market. Want to discover how you can benefit from these underappreciated opportunities? Read here

- Why Credit Investments Outshine Equities in Today’s Economic Landscape – Despite the potential for rate cuts, the current market cycle favors credit over equities due to their strong balance sheets and lower risk-adjusted returns, while the risk of deflation from China’s overcapacity looms large over the global economy. Want to learn how to navigate the complex market landscape and find the most profitable investment opportunities? Watch here

- From Cyclical Truck Loans to Robust Growth and Market Potential – As a result of a strategic merger, Shriram Finance has transformed from a cyclical, low-growth business to a diversified, profitable, and rapidly growing financial services company. Despite its impressive fundamentals and strong growth prospects, the company’s stock remains undervalued. Read here

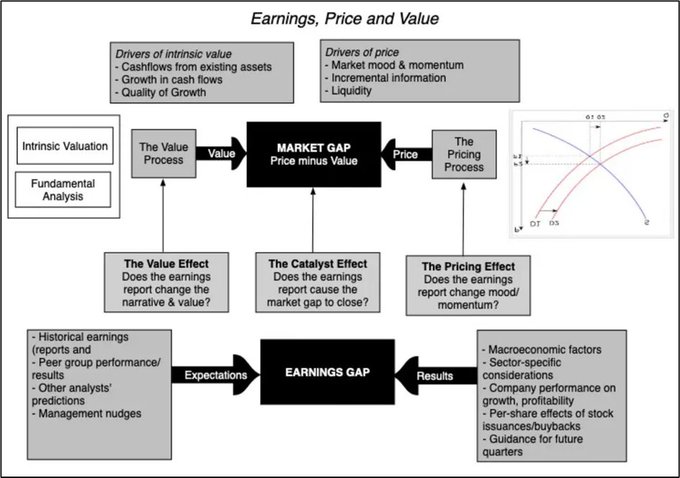

- Why Stellar Results Didn’t Prevent a Stock Drop – Despite strong earnings, Nvidia’s stock declined following its recent report. While the company’s fundamentals remain solid, market sentiment and expectations for future growth may be influencing the price. To understand the deeper implications of Nvidia’s earnings report. Read here

- Avoiding the Pitfalls of Blind Investing and Mastering Stock Picks Without Leading Followers to Slaughter – In the world of investing, just like in the slaughterhouse, there are those who lead others to their downfall. These “Judas goats” lure unsuspecting investors into risky ventures, often with disastrous consequences. To learn how to avoid becoming a victim of these financial predators. Read here

- How Stop Losses and Mental Toughness Shape Sustainable Investing – In the world of investing, survival is paramount. While it’s tempting to chase high returns, it’s crucial to prioritize risk management. Stop losses can help protect your portfolio from significant drawdowns and ensure you stay invested for the long term. To learn how to implement stop losses effectively. Read here

Economy

- Fallout of a Growing Youth Population – India’s burgeoning youth population, coupled with a mismatch between education and job opportunities, has created a significant unemployment crisis. This issue has far-reaching implications, impacting the economy, society, and politics. To learn more about the root causes and potential solutions to India’s unemployment problem. Read here

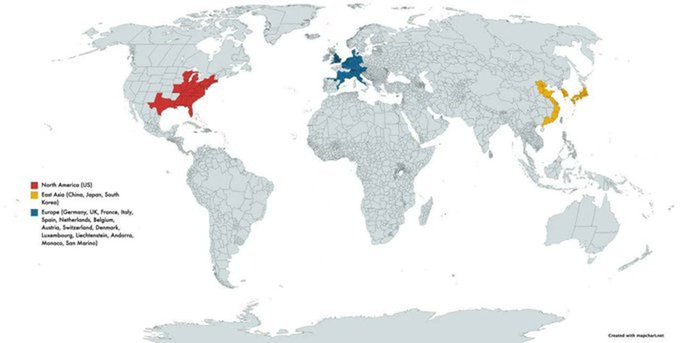

- Biosecure Act: How US Policy Could Propel India’s Pharma Industry Ahead of China – The Biosecure Act, if passed, could significantly benefit the Indian pharma sector by diverting business away from Chinese companies. This presents a huge opportunity for Indian firms to expand their market share and capitalize on increased demand from the US. If you’re curious about which Indian pharma companies are poised to benefit from the Biosecure Act. Watch here

- Governor Stresses Patience Amid Easing Inflation – RBI Governor, Shaktikanta Das, has expressed optimism about India’s economic growth potential, citing the country’s strong fundamentals and the easing of global inflation. However, he cautioned against premature interest rate cuts, emphasizing the need to remain vigilant about inflationary pressures. Learn more about India’s economic prospects and the RBI’s monetary policy stance. Read here

***

Check out CAGRwealth smallcase portfolios

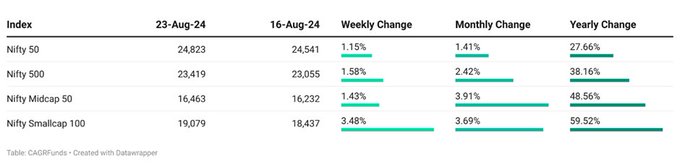

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked among Top 5 smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 25 across the smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.