CAGR Insights is a weekly newsletter full of insights from around the world of the web.

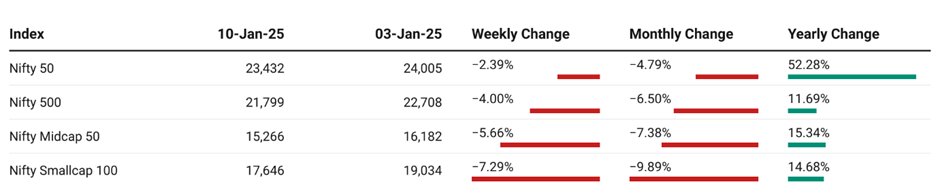

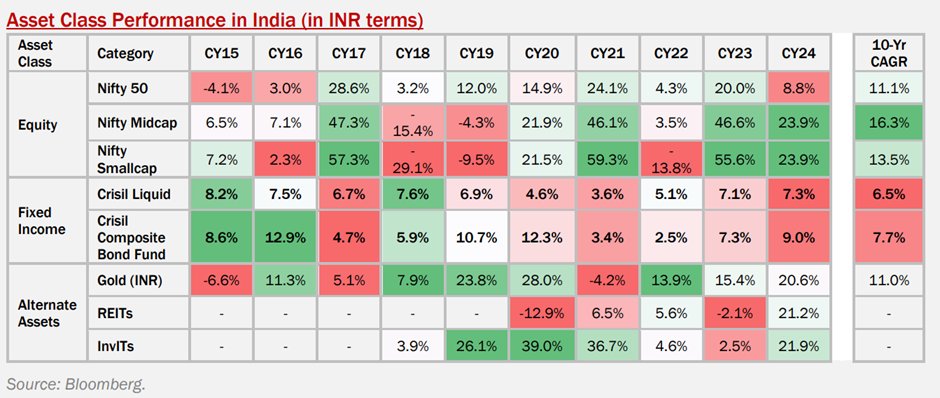

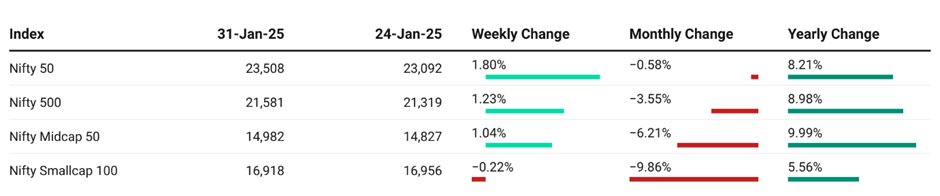

Chart Ki Baat

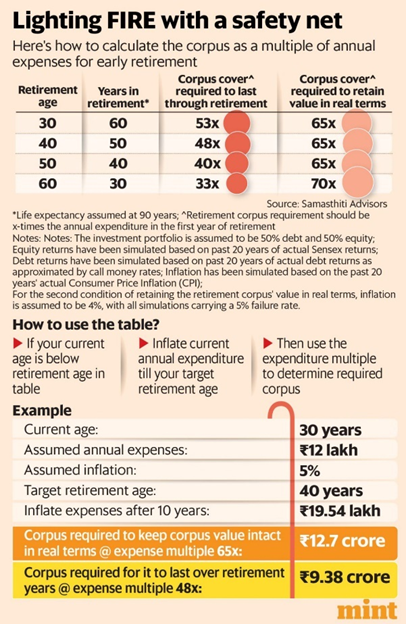

Gyaan Ki Baat

As India approaches the Union Budget 2025, set to be presented on February 1, 2025, expectations are high across various sectors. Here are the key highlights and anticipated reforms:

Key Expectations from Union Budget 2025

- Income Tax Reforms:

- There is speculation about potential changes in income tax slabs, including the possibility of introducing zero income tax for individuals earning less than ₹10 lakh annually. Additionally, a shift towards phasing out the old tax regime may be considered to simplify tax compliance and enhance disposable income for taxpayers.

- Focus on Agriculture:

- The budget is expected to emphasize agricultural growth, with calls for increased Minimum Support Prices (MSP) and enhanced funding for rural development initiatives. This aligns with the government’s ongoing efforts to support farmers and boost food security.

- Support for MSMEs:

- Recommendations include allocating additional funds to strengthen investments in renewable energy projects, particularly in compressed biogas and biomass sectors. This aims to make Micro, Small, and Medium Enterprises (MSMEs) more agile towards environmental compliance.

- Housing Sector Reforms:

- The housing sector is likely to see significant reforms, including increasing the tax deduction limit on home loan interest payments from ₹2 lakh to ₹5 lakh. Granting infrastructure status to the housing sector could unlock new investment avenues and stimulate demand.

- Infrastructure Investment:

- Continued emphasis on infrastructure development is anticipated, with proposals for substantial allocations towards roads, railways, ports, and digital infrastructure to enhance connectivity and stimulate economic activity across the country.

- Healthcare Sector Support:

- The healthcare sector is hoping for a reduction in GST rates on health insurance and healthcare products. Increased funding for public health initiatives is also expected to address ongoing challenges within the healthcare system.

- Green Energy Initiatives:

- With a focus on sustainability, the budget may include measures to bolster investments in renewable energy sources such as solar technologies and green hydrogen. Enhanced budgetary allocations for these sectors are seen as crucial for achieving India’s ambitious renewable energy targets by 2030.

- Fiscal Responsibility:

- The government aims to maintain a fiscal deficit target of 5.1% of GDP for FY25, balancing the need for public spending with fiscal consolidation efforts.

Conclusion

The upcoming Union Budget 2025 presents an opportunity for the Indian government to address critical economic challenges while fostering growth across various sectors. Stakeholders from agriculture, MSMEs, housing, healthcare, and renewable energy are keenly awaiting reforms that will not only stimulate economic activity but also enhance overall quality of life in India.

Personal Finance

- UPI transaction won’t work from Feb 1 if ID contains special characters: The National Payments Corporation of India (NPCI) has said that from February 1 people can’t use special characters in Unified Payments Interface (UPI) identity (ID). All such information has to be alphanumeric. Read here

- 8th Pay Commission approved: Central government employees may see 186% rise in pension: The 8th Central Pay Commission (CPC), which will come into effect from January 1, 2026, will revise salaries, pensions, and allowances, benefiting more than one crore central government employees and pensioners. Read here

- EPF members can now use Digilocker to submit Joint Declaration (JD) requests for profile related changes: The Employees Provident Fund Organisation (EPFO) has issued a circular outlining a simplified method for submitting Joint Declaration (JD) requests, which replaces the existing SOP Version 3.0 dated July 31, 2024. Read here

Investing

- Consumer Lending Unlocked: Opportunities and Risks in a $27 Trillion Market: Consumer lending is booming, fuelled by tech and evolving consumer behaviour. With a $27T market, it spans traditional mortgages to BNPL loans. While offering exciting opportunities, risks like transparency issues and subprime exposure demand careful investor scrutiny and regulatory adaptation. Read here

- Lower budget borrowing may add to India cash boost cheer: India will likely reduce its net borrowings for the second consecutive year, which may extend the rally in Indian bonds as the government aims to adhere to its fiscal consolidation path. The central bank’s measures have brought bond yields to a three-year low, with major purchases expected to ease cash deficits and support the financial market. Read here

- Foreign investors are fleeing India’s stock market — but analysts see long-term potential: Indian equities have been dragged down by a cooling economy and an exodus of foreign investors. Analysts suggest the downturn could be a healthy correction, and opportunities in India’s market remain. Read here

Economy & Sectors

- India’s finance minister faces a tough choice crafting the annual budget — boost growth or cut deficit? As the Indian government walks a tight rope between fiscal prudence and reviving growth, experts suggest it will likely favour cutting deficit in its annual budget over spending aimed at turbocharging Asia’s third-largest economy. Read here

- US Fed Keeps Benchmark Rate Unchanged: What It Means for India’s Economy? The US Fed held rates at 4.25-4.50%, signalling caution on inflation despite a strong job market. For India, this could mean RBI rate cuts, a stronger rupee, lower inflation, cheaper imports, and shifting foreign investments influencing stock market sentiment. Read here

- India’s digital economy to contribute one-fifth of overall economy by 2030: Over the past decade, digital-enabling industries have grown at 17.3 per cent, significantly higher than the 11.8 per cent growth rate of the economy. Digital platforms have expanded rapidly, with an anticipated growth rate of approximately 30 per cent in the coming years. Read here

Check out CAGRwealth smallcase portfolios

Our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.