CAGR Insights is a weekly newsletter full of insights from around the world of the web.

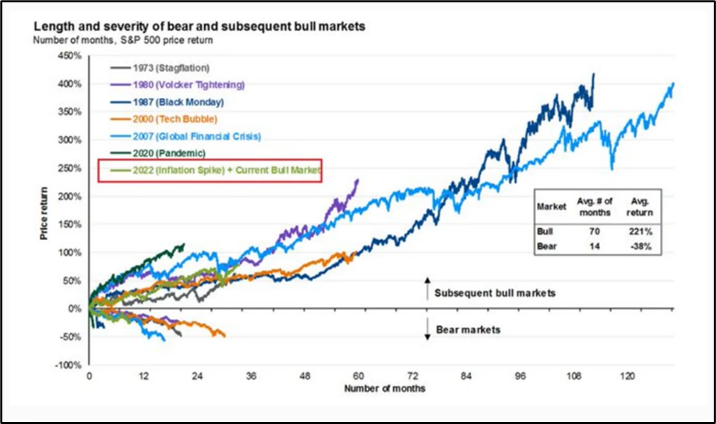

Chart Ki Baat

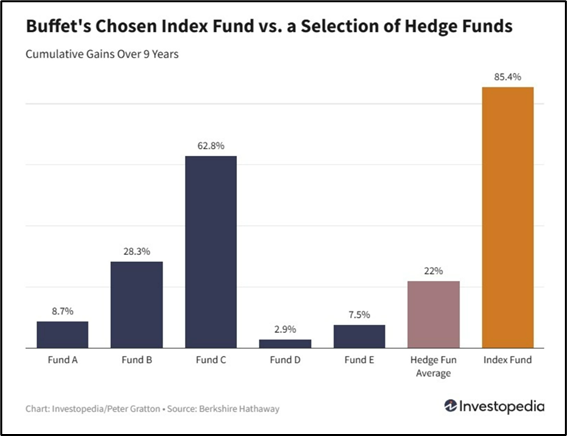

Gyaan Ki Baat

The Wealth Gap You Don’t See

At a recent get-together, Meera and Rohan noticed a pattern. While most of their friends spent the evening discussing school admissions, tuition fees, and rising child expenses, the couple — both in their 30s, working in IT — stayed quiet. Not because they had nothing to add, but because their financial reality looks very different. They’ve chosen the DINK lifestyle — Double Income, No Kids.

At first glance, it may look like just a lifestyle choice. But financially, it’s a game-changer. With a household income of ₹30 lakh, Meera and Rohan spend about ₹18 lakh a year and invest the remaining ₹12 lakh into SIPs. At a conservative 12% return, they could build a corpus of ₹17 crore in 25 years — enough to retire nearly a decade early.

Now compare that with a similar couple raising a child. Monthly child-related costs like school fees, food, healthcare, and an education corpus easily eat up over ₹42,000 every month. This shrinks their investible surplus from ₹1 lakh to about ₹58,000. Over 25 years, that difference compounds into a staggering gap of more than ₹7 crore.

But here’s the real takeaway: the advantage isn’t simply in not having kids. It’s in what you do with the surplus. DINK couples who give in to lifestyle inflation — bigger cars, luxury vacations, premium apartments — lose the same edge.

The true gyaan? Financial freedom isn’t about whether you have kids or not. It’s about discipline. Channel your savings into consistent, goal-based investments — and let compounding do the heavy lifting.

Personal Finance

- Can you change your tax regime from new to old and vice-versa, while filing ITR? Not always: For FY 2024-25, the new tax regime is the default, impacting ITR filing. Switching to the old regime requires careful consideration, especially for those with business income who must file Form 10-IEA before the due date. While revised ITRs allow regime changes, belated ITRs restrict this option, emphasizing the importance of timely filing. Read here

- RBI may allow banks to lock the phones bought on credit if buyer defaults on repayment: Report: Last year, the Reserve Bank of India asked lenders to halt locking phones of defaulting borrowers, the sources said. The practice involved using an app installed at the time of loan issuance to lock the devices. Read here

- No generational wealth, how a Reddit user grew net worth to Rs 60 lakh; check details: A Redditor explains his journey from a Rs 5,000 salary to a net worth of Rs 60 lakh through disciplined financial habits, highlighting the role of structured investments and strategic risk management. Read here

Investing

- The Bar Only Gets Higher: Wealth-building is tougher than ever—global rivals, soaring costs, and AI raise the bar. But persistence beats all. Want to know the hidden edge to thrive today? Read here

- How FIIs Have Played the Indian Market: FIIs master the art of buying low, selling high, and shifting between equity and debt. Want to know the biggest lesson they teach Indian investors? Read here

Economy & Sector

- India’s Real Estate to scale up office and industrial assets beyond 2 billion sq ft by 2047: India’s real estate is set to scale into a $5–10 trillion market by 2047, driven by urbanization, demographics, tech, and sustainability. Curious how each asset class will transform? Read here

- GST reform: Indian companies likely to witness up to 7% growth in revenues after new rates, says Crisil: Research agency Crisil says that due to the reduced goods and services tax (GST) rates, Indian companies are expected to witness a 6-7% rise in revenues in the financial year 2025-26. The new GST structure will be effective from 22 September 2025. Read here

- India plans to put large infra projects in fast lane: India is accelerating its infrastructure development with a focus on mega-projects like bullet trains, shipbuilding yards, and access-controlled highways, aligning with the Viksit Bharat 2047 vision. The government aims to boost economic growth through infrastructure creation, encouraging public-private partnerships to moderate spending. Ministries are directed to expedite project approvals, with a high-level committee reevaluating goals for faster clearances. Read here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.