The list of top performing stocks or mutual funds keeps changing frequently. This is of course obvious as the performance depends on various factors and some of these factors are not completely in control of the company’s management. Even good companies with sound management will face ups and downs. There is one obvious question that comes to every investor’s mind – Do we keep churning our portfolio frequently to exit the underperformer and buy the outperformer? My answer to this is overwhelming ‘No’. I believe churning of your portfolio too frequently will do more harm than good.

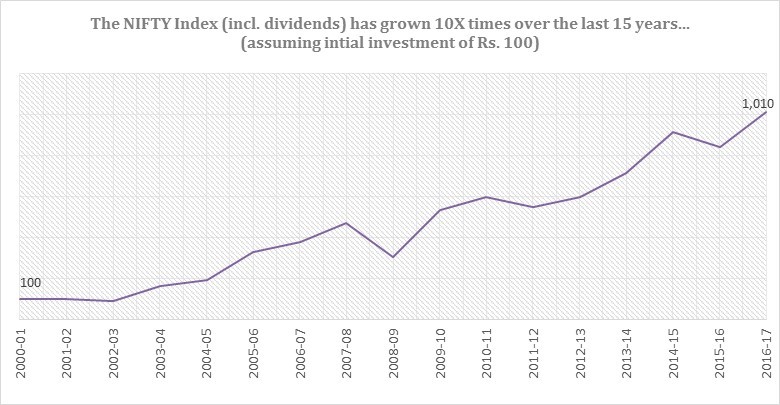

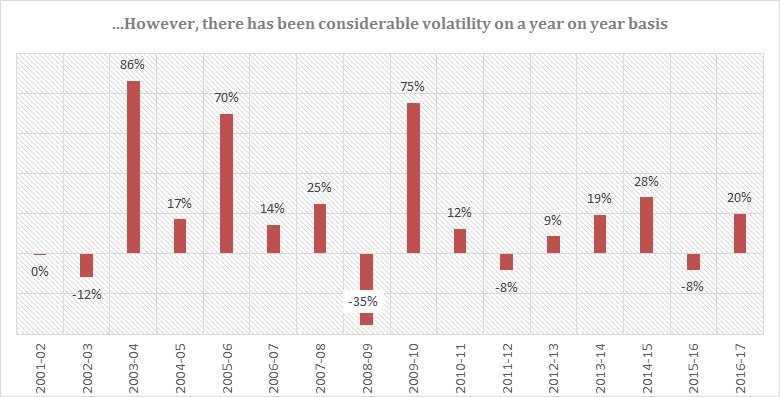

Let me try to explain further. During the last 15 years, Nifty (including dividend) has grown at an annual rate of 16.7%, to put it in simple terms, Rs. 100 invested 15 years back has now grown to more than 10 times. But, having said that, equity as an asset class is known to be volatile in short periods (see chart below). So, while investing in equity for short term may be tricky, the odds of making money in the long term are quite high.

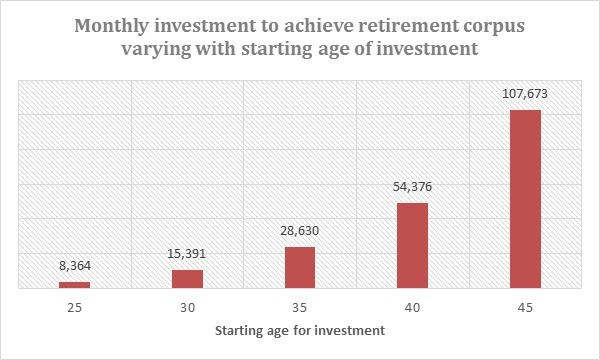

Now, let us come back to ‘Power of Compounding’, which we had touched briefly in my last article (Read here). This has to be one of the most important financial lessons of all time. As the great Albert Einstein said “Compound interest is the eighth wonder of the world. He, who understands it, earns it … he who doesn’t … pays it”.

Here, we will see how holding your portfolio for the long term helps power of compounding play its magic in the most unusual way. If you hold your portfolio for long term, the winners in your portfolio will tend to become dominant, and the losers will become insignificant. The positive impact of the winners will significantly outweigh the negative contribution and your portfolio will compound significantly. Not sure, right? I can understand your circumspection.

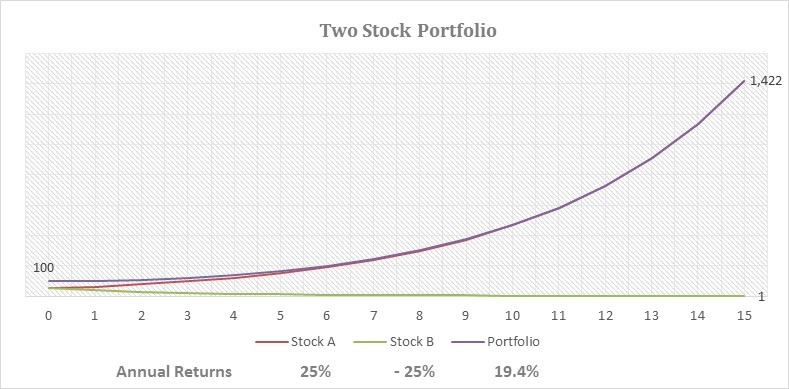

Let me explain this by taking a simple two stock portfolio. Stock ‘A’ is a winner, gives 25% annual return over a period of 15 years, while Stock ‘B’ is declining by 25% annually. How has your portfolio performed? I would say good, rather great. Your portfolio has given an annual return of 19.4%. This example demonstrates the power of compounding.

This magic can also work for you. You just have to be patient and give your money long enough time to grow.