CAGR Insights is a weekly newsletter full of insights from around the world of the web.

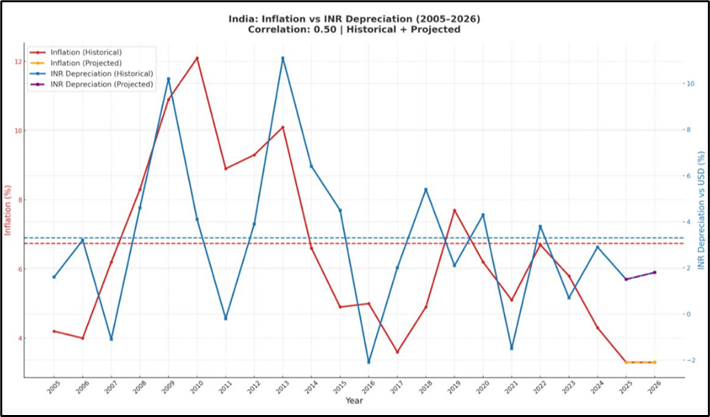

Chart Ki Baat

Gyaan Ki Baat

The Price You Pay vs. The Value You Get

In most areas of life, we love bargains. We hunt for discounts, compare prices, and take pride in getting more for less. But in investing, this instinct often flips. When prices fall, we panic. When prices rise, we rush in—fearing we’ll miss out.

This psychology is more than just curious—it’s costly. True wealth in the markets is built by doing what feels uncomfortable: buying when others are fearful, holding steady when noise gets loud, and focusing not just on price, but on value.

What does that mean? As Warren Buffett famously said, “Price is what you pay. Value is what you get.” A stock with a low-price tag isn’t always a good deal. And an expensive-looking stock might be worth every rupee. The real question is: Are you paying a fair price for the quality of the business you’re buying?

In today’s market, with headlines buzzing and past performance chasing driving decisions, this principle matters more than ever. It’s easy to confuse data with insight, or popularity with potential. But investors who tune out the noise and focus on the basics—understanding the business, evaluating its earnings, and assessing its true worth—are the ones who win over time.

The market can stay irrational longer than you think. But if you stay rational and grounded in value, you give yourself a long-term edge.

Personal Finance

- India one of the most affordable places to retire: HSBC report reveals how much you need: Affluent Indians now need ₹3.5 crore to retire comfortably—less than a third of what’s needed in the U.S. ($1.57M). Driven by inflation and macro risks, they’re shifting from equities to gold, alternatives, and expert-led, diversified investment strategies. Read here

- Have money abroad? IT dept’s new guide spells out what & how to report: CBDT’s latest guide explains how resident Indians must disclose foreign income and assets in ITR this year, missed details can lead to penalties under the Black Money Act.Read here

- Investing in volatile markets: SIP STP or Lumpsum investment, which strategy wins? Explained: Navigating volatile markets is often difficult for investors. No one knows which side the markets could move and when. Volatile markets could rise for a week but then suddenly fall and wipe off the gains of the whole week. So, how does one invest during such times? Read here

Investing

- Debt funds vs arbitrage funds: How to pick the right one for short-term goals: Debt funds suit low-risk investors needing stable returns and liquidity for a few weeks to years. Arbitrage funds offer tax efficiency for high-income investors with a 6+ month horizon. A mix of both balances returns, liquidity, and tax benefits. Read here

- Will interest rates continue dropping this year? Interest rates have declined since the Fed’s rate cuts last year. So, will they keep going down? Read here

- Are We Heading Towards Another Bubble Burst? Semiconductors now dominate the S&P 500—just like tech did before the dot-com crash. Insiders are selling, risks are rising. Is another bubble brewing? Read here

- The Best Leading Indicator of Wealth: Want to predict future wealth? Don’t ask about IQ or college—ask about income. It’s the clearest sign of where you’re headed. Want to grow yours? Read here

Economy & Sector

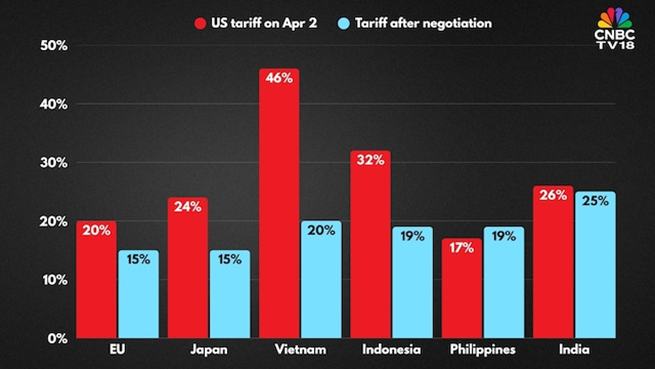

- What Trump’s 25% tariff could mean for India’s GDP: Trump’s 25% tariff on Indian imports may hit GDP, exports, and US-India ties hard. Pharma at risk. Experts warn of blackmail—but is a full-blown trade war looming? Read here

- India refuses to play ‘dead economy’. Will Trump back off? In response to U.S. tariffs and disparaging remarks, India has asserted its stance on trade negotiations. Commerce Minister Piyush Goyal emphasized India’s commitment to protecting its stakeholders and refusing deals under pressure.Read here

- 25% tariff bomb: India’s electronics, pharma, textiles to be worst hit: US President Donald Trump has announced a 25 per cent tariff and secondary sanctions on Indian goods starting August 1. Key export sectors like electronics, pharmaceuticals, and textiles are expected to face significant headwinds. Read here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.