CAGR Insights is a weekly newsletter full of insights from around the world of the web.

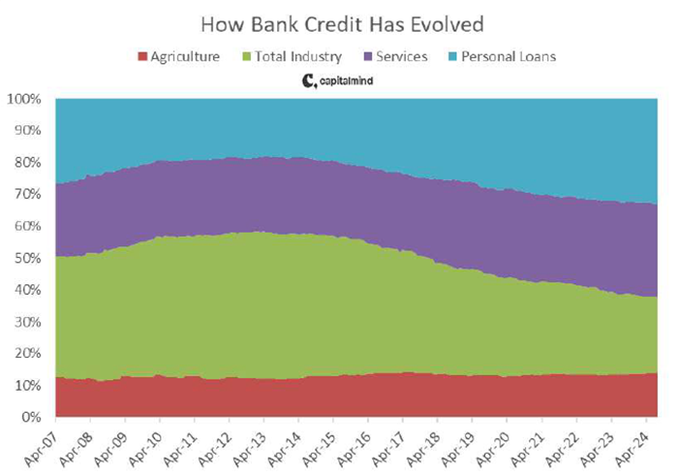

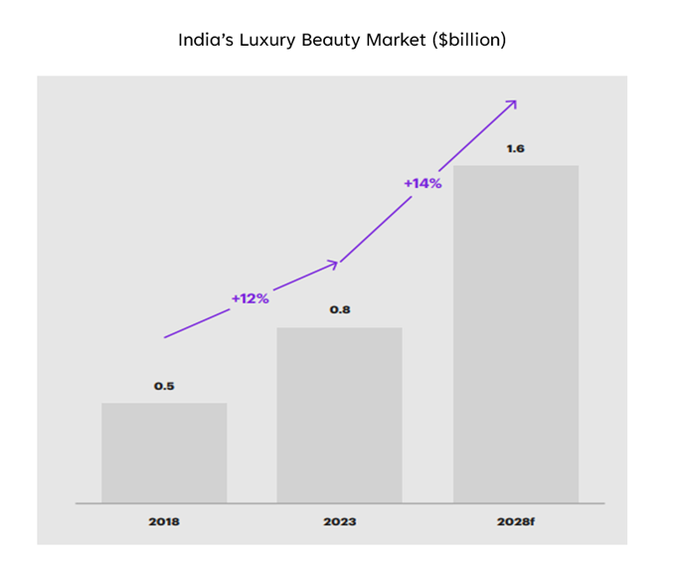

Chart Ki Baat

Source: Bloomberg

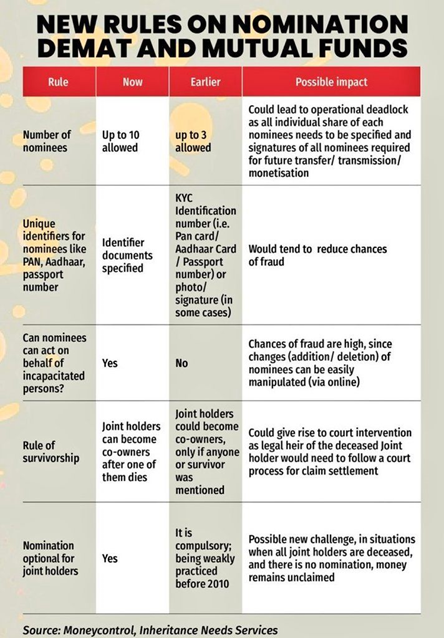

Gyaan Ki Baat

Mind Over Money: How Behavioural Biases Shape Your Investments

Investing is not just about numbers and market trends—it’s also deeply influenced by psychology. Our emotions and inherent biases often shape the financial decisions we make. Understanding these behavioural biases can help investors make more informed, rational choices and avoid common pitfalls in their investment journey.

Here are some common behavioural biases that can impact financial behaviour:

Overconfidence: Investors often overestimate their abilities and knowledge, leading to riskier investments.

Loss aversion: People tend to feel more pain from a loss than pleasure from a gain, making them reluctant to sell losing investments.

Herding: Investors often follow the crowd, buying or selling assets based on popular trends rather than fundamental analysis.

Anchoring: Investors may anchor their decisions to irrelevant information, such as the initial purchase price of a stock.

Confirmation bias: Investors seek information confirming their beliefs while ignoring contradictory evidence.

Understanding these biases can help investors make more informed decisions and avoid costly mistakes. By recognizing and mitigating the effects of these biases, individuals can improve their financial outcomes. Here’s the list of curated readings for you this week:

Personal Finance

- Are you investing in Gold this Dhanteras? Finance Ke Funde is here! 💰✨Join Shruti and Vikash in our first episode as they explore the world of gold. We’ll talk about everything from its cultural significance to its investment prospects. Discover why gold prices fluctuate worldwide, how they compare to Indian markets, and much more! Watch here

- The Low Stability of High Income: Is your high salary a ticking time bomb? High-income earners, especially in volatile industries face the risk of sudden income loss. Discover how unchecked spending and job volatility could quickly derail your financial future—and what you can do to stay secure. Read here

- Soaring Markets Trigger Family Disputes: Family disputes in India’s business empires are escalating as market valuations soar. From the Oberoi family to the Kalyanis, legal battles are intensifying over competing wills. With family businesses contributing 75% of GDP, how will these conflicts shape the future? Read here

Investing

- The Run: Archie Karas went from rags to riches, turning $50 into $40 million, only to lose it all. His story mirrors the risky nature of stock picking, where discipline, conviction, and smart risk-taking are crucial to long-term success. Read here

- Measuring Performance – How to Choose the Right Benchmark: Benchmarking in investing shouldn’t focus on niche indices that may distort performance comparisons. True progress lies in absolute returns against major indices like the S&P 500, reflecting real investment alternatives. Choosing the right benchmark is crucial for long-term success. Read here

- How a Pune investor’s complaint blew the lid off ‘Rs 900-cr’ fraud linked to OctaFx forex trading platform: In a major crackdown, the Pune Police and ED unearthed a Rs 900 crore foreign exchange scam targeting over 500 hearing-impaired victims. Find out how this elaborate scheme was orchestrated and who’s now under investigation. Read here

- RBI governor says “Can’t risk another bout of inflation, need cautious approach”: India’s Monetary Policy Committee remains cautious on rate cuts, emphasizing the need to control inflation amid rising food prices. As demand wanes, a lone voice calls for cuts to boost private investment. Read here

Economy & Sectors

- The changing face of India’s rich: India’s wealth landscape is transforming, with new-age millionaires rising from startups, sports, and stocks. As wealth shifts from traditional assets to financial markets, learn how this fresh affluence is reshaping consumption and investment trends. Read here

- What the Coldplay event tells us about new India: India’s evolving consumer culture reveals a deep-rooted shift toward visible wealth and status, often fueled by credit and social pressure. As spending rises, so do questions: Are we finding true fulfilment, or just chasing validation? Read here

- Understanding EMS – The backbone of the global electronics market: India’s Electronics Manufacturing Services (EMS) market is projected to grow at a remarkable CAGR of 32.3% from 2021 to 2026, driven by domestic production initiatives and rising electronic consumption. Explore how this shift is reshaping the landscape of manufacturing. Read here

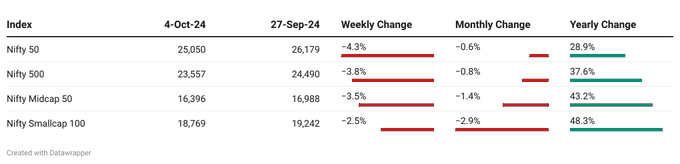

Check out CAGRwealth smallcase portfolios

Both our smallcase portfolios are ranking well in the smallcase universe in terms of 1-year returns.

• CFF (launched in June 2022) – Ranked 1st amongst smallcase with medium volatility.

• CVM (launched in May 2022) – Ranked among Top 20 across the Momentum smallcase universe.

Do check it out here

****

That’s it from our side. Have a great weekend ahead!

If you have any feedback that you would like to share, simply reply to this email.

The content of this newsletter is not an offer to sell or the solicitation of an offer to buy any security in any jurisdiction. The content is distributed for informational purposes only and should not be construed as investment advice or a recommendation to sell or buy any security or other investment or undertake any investment strategy. There are no warranties, expressed or implied, as to the accuracy, completeness, or results obtained from any information outlined in this newsletter unless mentioned explicitly. The writer may have positions in and may, from time to time, make purchases or sales of the securities or other investments discussed or evaluated in this newsletter.